Bitcoin Surges, SEC Talks

Bitcoin Surges to $37,000 as SEC Initiates Talks with Grayscale for BTC-ETF

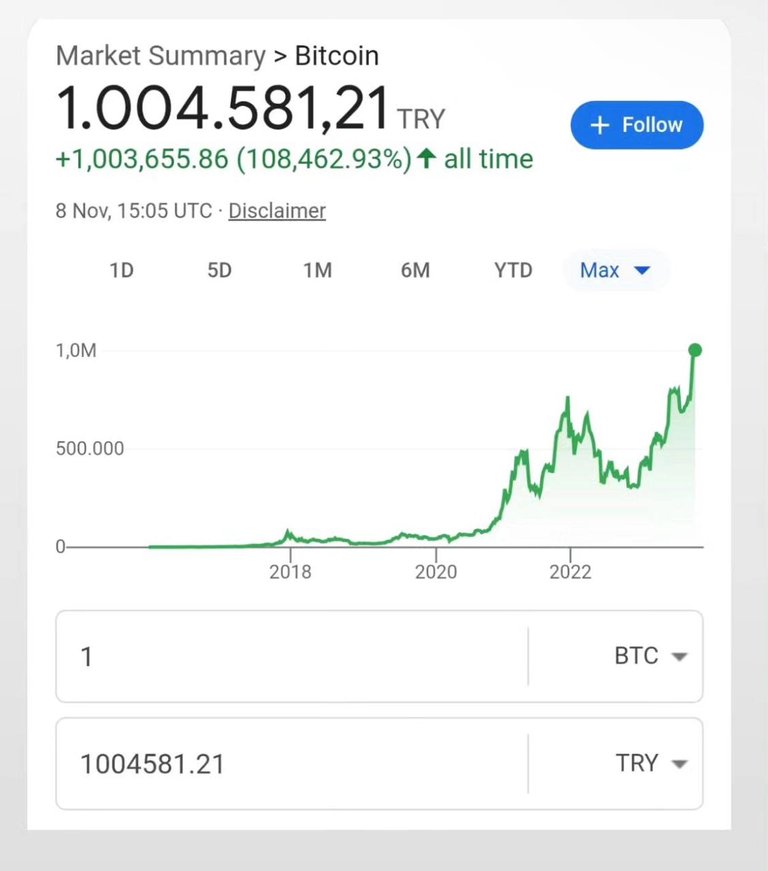

BTC is now worth a million At least in TR

Introduction:

In the ever-evolving world of cryptocurrency, Bitcoin has once again taken the spotlight with its remarkable surge to $37,000. This news has left investors, traders, and enthusiasts buzzing with excitement as the leading cryptocurrency displays a robust bullish trend.

Additionally, the U.S. Securities and Exchange Commission (SEC) has recently made a significant announcement regarding talks with Grayscale, potentially paving the way for a spot Bitcoin ETF. In this blog post, we'll explore these developments and what they mean for the cryptocurrency market.

Bitcoin's Ascending Triumph:

Bitcoin's recent price movement has captured the attention of the crypto community. It has demonstrated a remarkable show of strength by forming an ascending triangle pattern, a classic technical indicator often associated with bullish sentiment. Here's a brief breakdown of what transpired:

Formation of the Ascending Triangle: The first sign of optimism came as Bitcoin formed an ascending triangle pattern. This pattern is characterized by a series of higher lows and a relatively flat upper resistance line. It's seen as a bullish continuation pattern, indicating that Bitcoin was gearing up for a potential surge.

Breaking the Triangle Upwards: Bitcoin didn't disappoint its proponents as it decisively broke out of the ascending triangle pattern in an upward direction. This breakout signaled a shift in market sentiment towards a more bullish outlook.

Retest and Continued Growth: Following the breakout, Bitcoin underwent a retest of the previous resistance, now turned support. This retest is a common occurrence in technical analysis and often confirms the strength of the new bullish trend. After the retest, Bitcoin continued its ascent, further solidifying its bullish stance.

Implications of SEC Talks with Grayscale:

Beyond the impressive price action, the cryptocurrency community is abuzz with excitement over the SEC's announcement. The regulatory body has initiated discussions with Grayscale, a leading digital asset management firm, regarding the potential launch of a spot Bitcoin ETF.

A Bitcoin ETF is a highly anticipated development in the cryptocurrency market. It would allow traditional investors to gain exposure to Bitcoin without the complexities of holding and managing digital assets directly. The significance of these talks lies in the potential institutional adoption and mainstream acceptance of Bitcoin as a legitimate investment asset.

If successful, a spot Bitcoin ETF could open doors for a broader range of investors, including institutional players, retail investors, and retirement funds, to participate in the cryptocurrency market. This could lead to increased liquidity, reduced price volatility, and further validate Bitcoin as a store of value and an investment opportunity.

Conclusion:

The recent surge in Bitcoin's price to $37,000, along with its bullish technical pattern, has given the cryptocurrency community a reason to celebrate. It demonstrates Bitcoin's resilience and its ability to capture the imagination of both retail and institutional investors.

Additionally, the SEC's discussions with Grayscale regarding a potential spot Bitcoin ETF mark a significant step toward mainstream acceptance and could potentially redefine how traditional financial markets interact with the world of cryptocurrency.

As Bitcoin continues to make headlines and shape the financial landscape, it's an exciting time for those who have been holding this digital gold. The road ahead is paved with possibilities, and Bitcoin's journey is far from over. Stay tuned for more developments in this fast-paced,

You can find the same post on my Blurt page here Bitcoin Surges, SEC Talks