Gambling Dapp Dividends Report | More Rollbit Data (RLB)

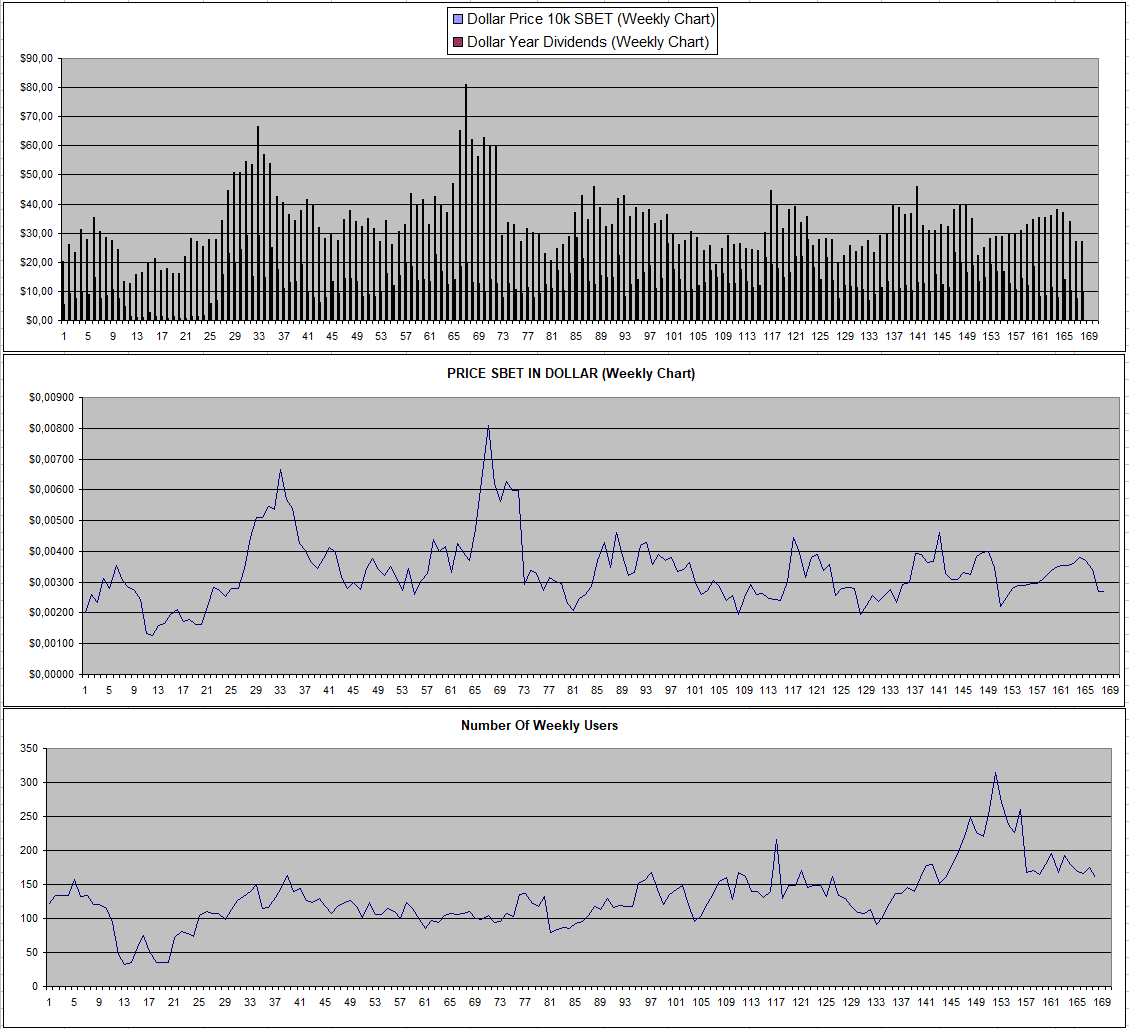

Sportbet.one (SBET)

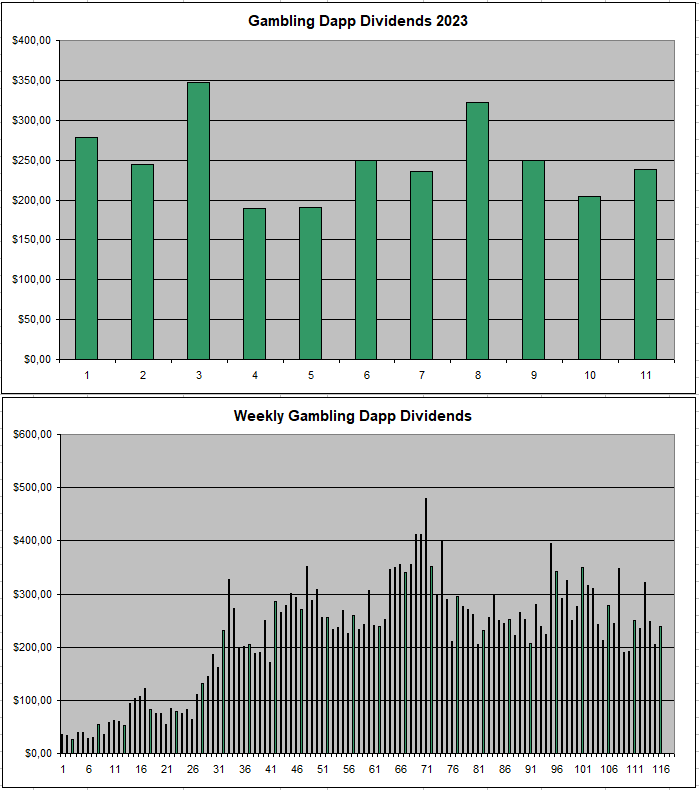

Sportbet continues to go its own way without all too much happening while dividends continue to be paid out weekly in a stable way. Things for sure are on the low end right now and the total market cap is at 1.35 Million which seems fair based on the actual returns which are at 30% based on the current price and the paid out dividends.

There is no real signs of increased volume and I do expect SBET to underperform in case there would be another bull market. That said, at current prices I'm not selling and I'm glad with the stability getting more funds each week to re-invest into mostly other altcoins.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

I've been tracking the stats from rollbit now for 7 weeks and am getting more data which I can start turning into charts.

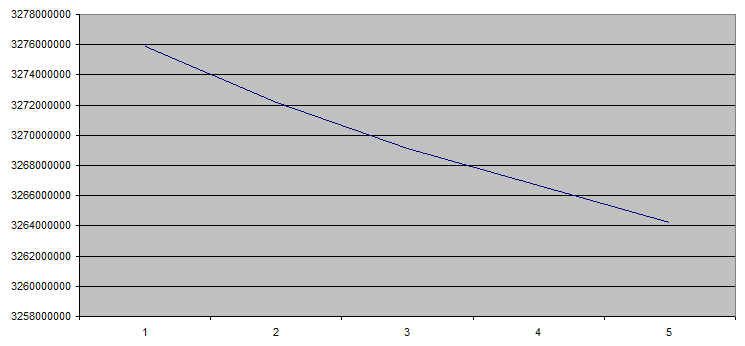

RLB Supply

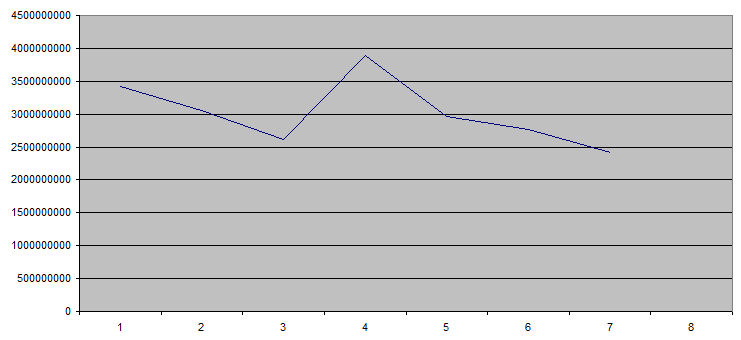

RLB supply is deflationary are 0.1% of the RLB locked toward the 10-11 weekly lotteries are burned. In the last 4 weeks, it added up to burns of -0.11% / -0.09% / -0.08% / 0.07% of the total supply so it seems to go down.

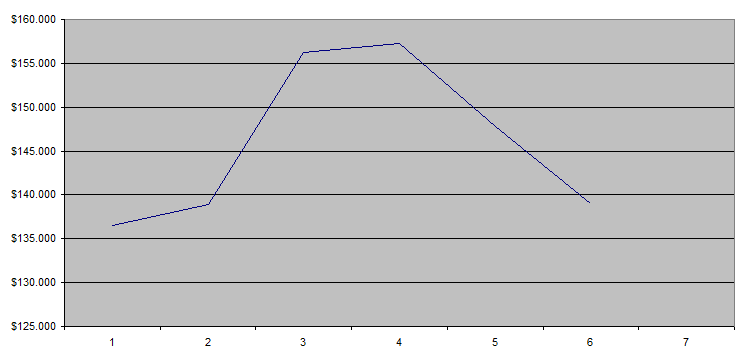

Weekly Lottery Value

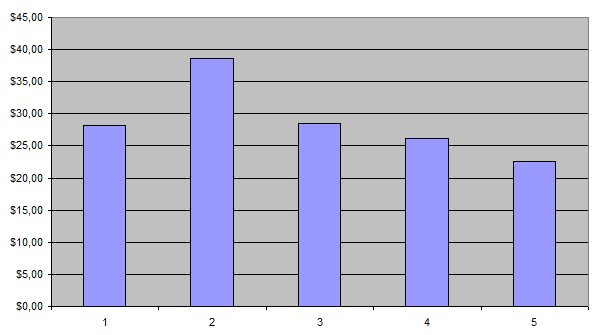

The total value that was put in the lottery (which equals 0.2% of the site profit) each week has ranged between 136k and 158k. It's probably more accurate to track the average lottery value as some weeks have 10 while others have 11 lotteries based as they are based on the bitcoin blocks.

There is also a big gap between actual payouts as there is the jackpot also from which something gets paid out at times.

RLB Staked Weekly (incl Multipliers)

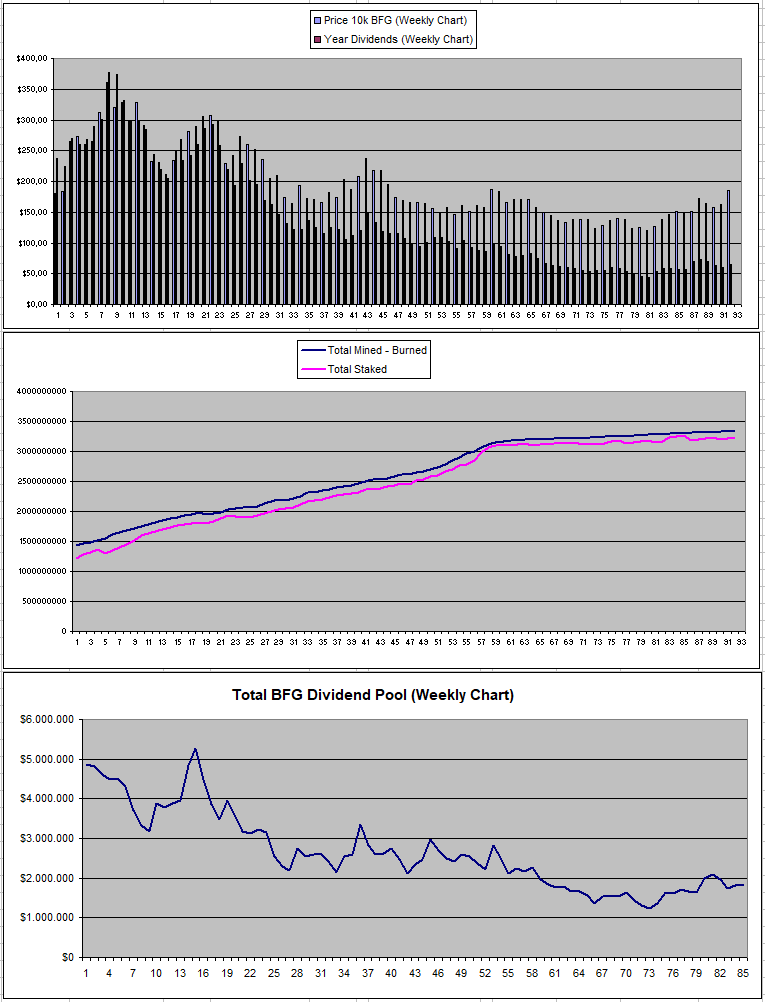

The average amount staked weekly has been somewhere between 3.9 Billion and 2.4 Billion RLB which includes multipliers so in reality it's a lot less. The 2 main factors are the price of RLB as the higher it is, the less gets staked as it needs to be profitable, and also the amount of money that is given in each individual lottery. The higher that is the more gets staked.

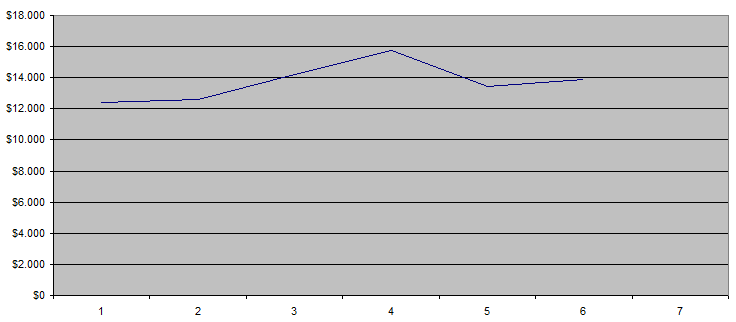

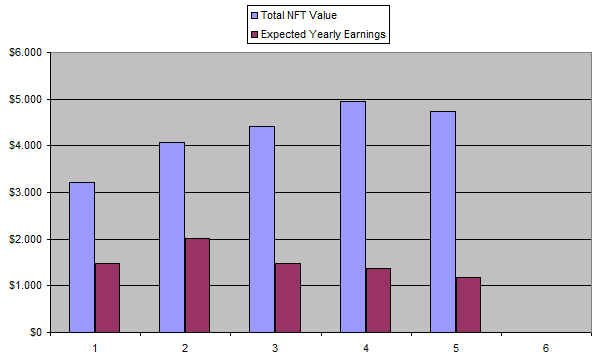

NFT Staking Earnings

These have been my earnings from 2 Rollot NFTs and 1 Sportsbot NFT, I honestly don't expect this to go up like crazy as rollbit already has quite a lot of adoption. Overall what matters is the overall yearly returns compared to the value of the assets.

The good thing is that I paid a lot less for my NFTs and I'm actually getting a much higher yield when looking at the percentage. Right now based on current prices it's +24.86% APY while based on the price that I paid it's +32.84% APY.

Right now I'm happy to hold on to what I have and see where it goes and I might start trading some RLB as the price pattern looks to be quite predictable and in worst case in the long run the supply decreases which makes the price go up.

Betfury.io (BFG)

There was a small push again in the dividends and the price also went up a bit for BGF.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Betfury.io (BFG) | +35.44% APY |

| Sportbet.one (SBET) | +30.21% APY |

| Rollbit.com (RLB) | +24.86% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own.

Personal Gambling Dapp Portfolio

There was a slight increase again compared to last week getting close to 240$ in dividends for holding 7.5M SBET | 600k BFG | 4730$ worth of Rollbot NFTs. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using as they allow anonymous betting with no KYC or personal restrictions...

|  |  |  |

|---|

|

|

|

|  |  |

|---|

Posted Using LeoFinance Beta