GambleFi Portfolio | Just.Bet Live on WINR Chain!

It was a pretty good week again for GambleFi with the portfolio earning close to 350$ during the past 7 days. Some of the platforms are also making some progress moving forward.

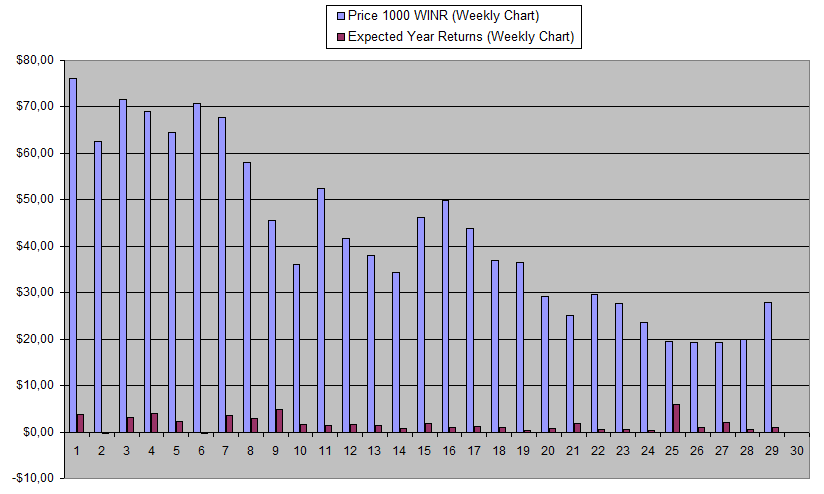

Things are moving along for WINR as Just.Bet launched on the WINR Chain which similar to sx.bet should take care of any gas fees. I'm not 100% up to date yet if there is anything I need to change or do to have my coins staked the way they were to earn some of the revenue. There was also a bullish video on youtube shilling the project (see below).

This likely is one of the reasons why the price pumped from 0.02$ which has been my main buying zone to now 0.0333$. I managed to get to 75k WINR and won't fomo in here to reach the 100k that I originally wanted. I see this as one of those projects where the price can pump easily based on hype but in the end, as there is revenue and something to measure, it always will come back to this.

Since I bought my first batch just to track the returns while getting familiar with the project, the returns never really have been there and based on the 0.0278$ price on Monday they represented 3.72% Yearly for having 66% in vWINR and 34% in WINR staked. I would say the fair value of the coin at the moment would be around a +10% APY. On the one hand there is the potential of future growth, but there is also the risk that it never really managed to obtain users (which by far always is the hardest step) or runs in to regulatory issues which tends to be the case for gambling a lot. This is the reason why most returns in GambleFi are around +30% APY as the risk is just very high. In the end, even though WINR aims to be a decetralized platform, 15% of the revenue goes to the devs which brings another risk as you need to rely on them doing their work. I'm also quite sure that their sportsbook will be 'useless' since it's hard to guarantee profit and the WPL Pool not to get in danger while offering competitive odds.

So overall for me, I like what they are doing but at the same time see many walls they need to break through still in order to really succeed. It remains a very speculative investment/gamble for me which may or may not work out.

What by now is an investment worth ~2500$ earned me just 1.49$ last week, this needs to be at least go 5x before I would consider buying more at current price as I'm not really getting sold on the idea alone that somewhere in the future this could do crazy numbers.

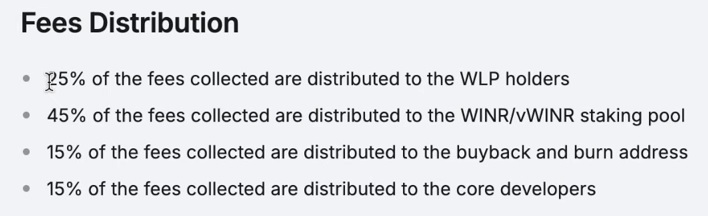

Defibookie (NFTs)

I looks like the re-launch will happen soon as they try to have it online before the start of the NFL Season.

I will start tracking the price and revenue from my 26 Defibookie NFT's again once the first revenue share or airdrops roll in.

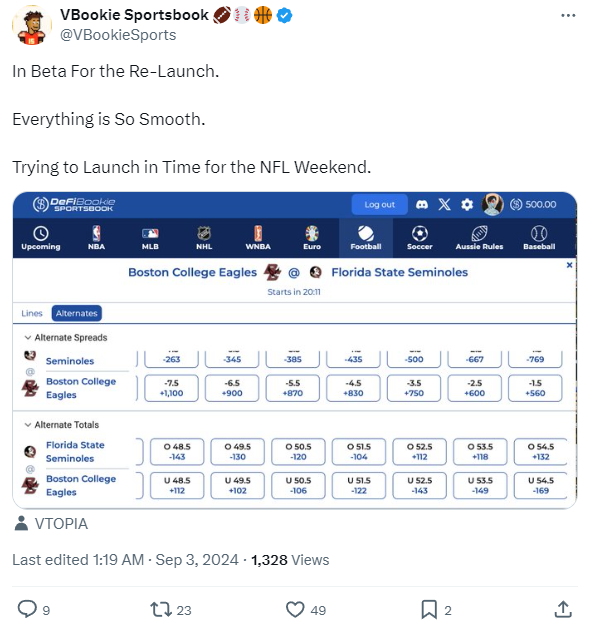

Sportbet.one (SBET)

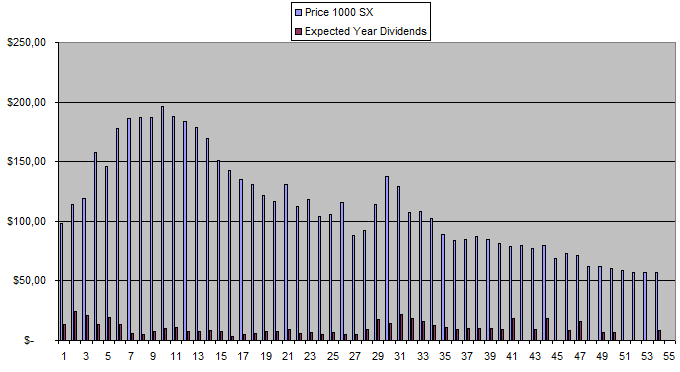

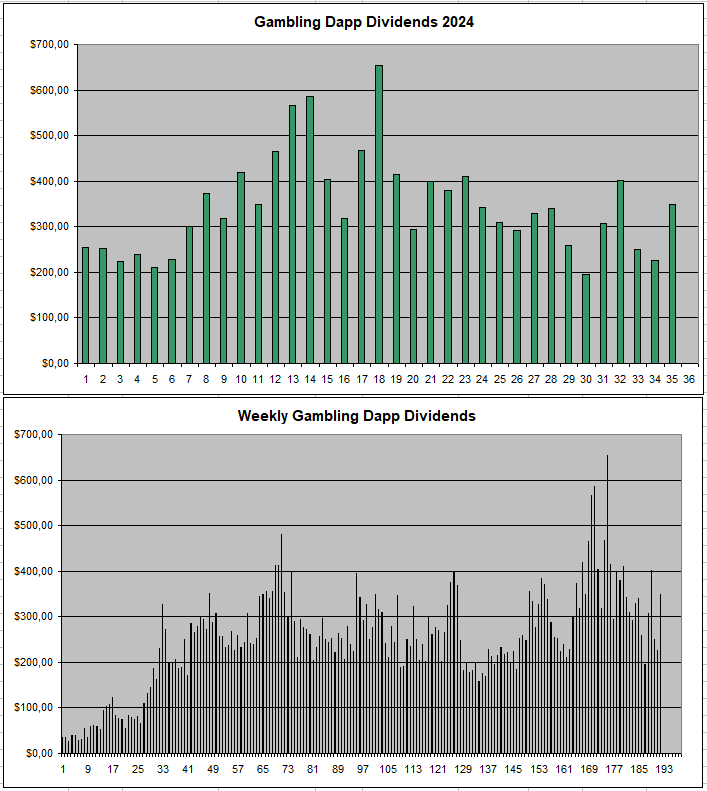

It was another reliable and solid week again for Sportbet and it looks like some more holders are coming in which pushed the price up +3.51% last week. Based on the returns last week the APY was +55% which is just very high for a more decentralized on-chain project that has been going strong now for 5+ years! It is so rare to see a project like this in crypto which just works allowing players to bet from their own wallet while never skipping a dividend playout with little to no drama or scamming.

One of the great things about this project is that the devs rely on holding SBET (~75% of the supply) to get earnings themselves. The main downside remains that it runs on EOS which for most players means that they have to use in a way where they deposit funds. The use of pBTC/pETH/pLTC is also rather annoying because the fees to convert are just way too high.

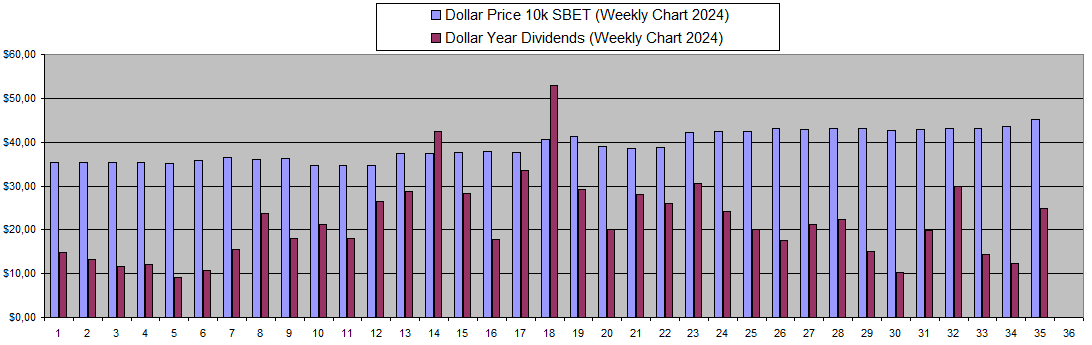

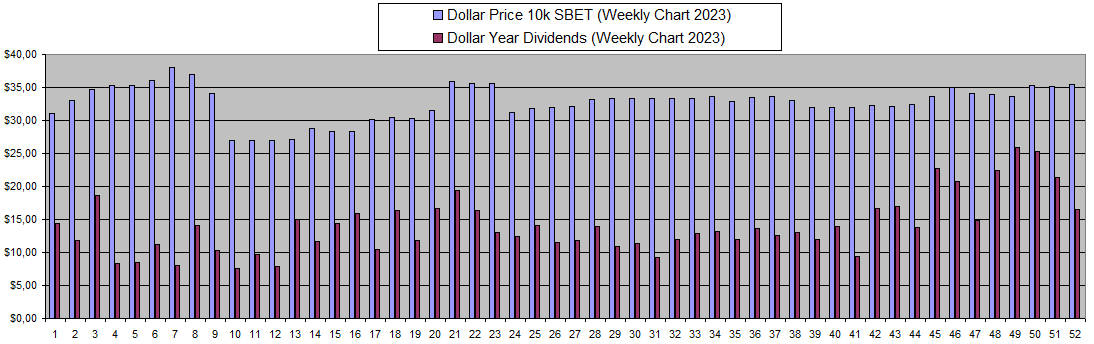

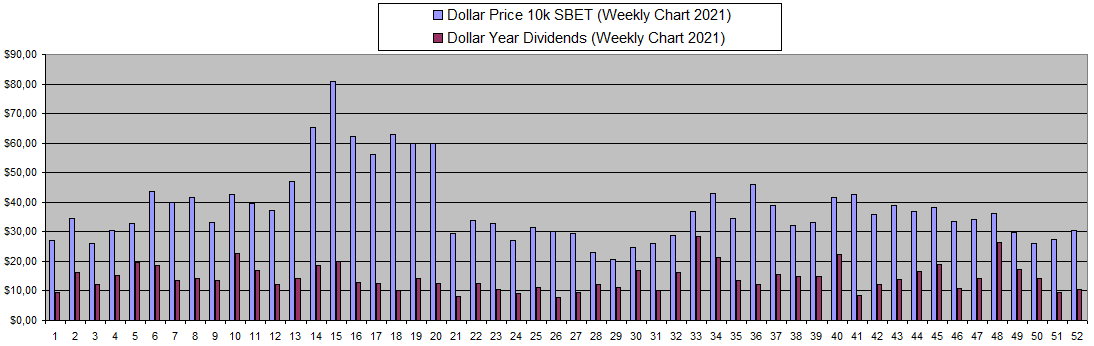

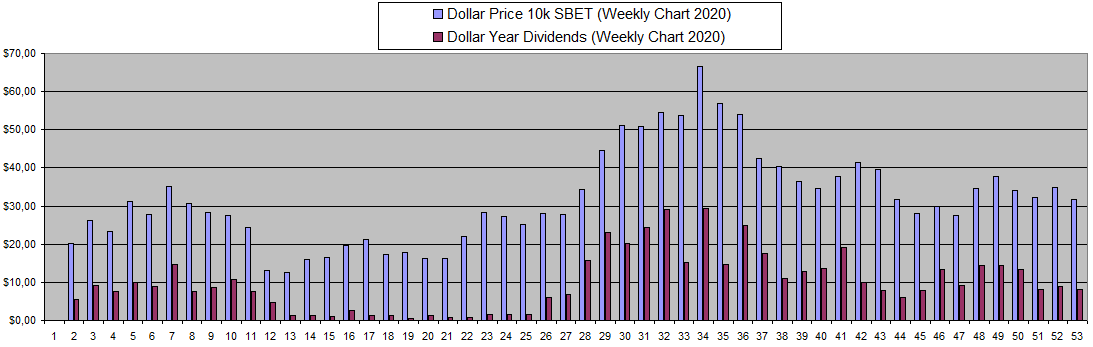

as the chart is getting so long as I have been invested tracking the returns for ~5 years, I will from here on out also add it just for the year which gives a clearer graph.

2024 SBET Dividends

2023 SBET Dividends

2022 SBET Dividends

2021 SBET Dividends

2020 SBET Dividends

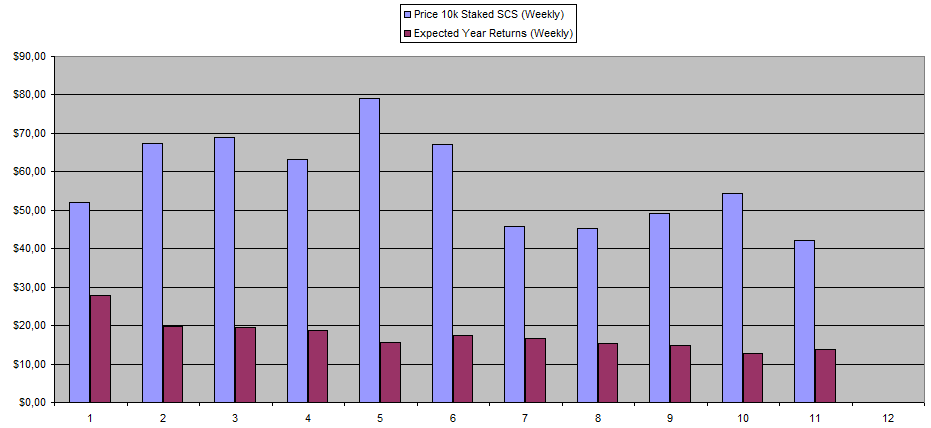

Solcasino.io (SCS)

There was another SCS burn this time 58.8M SCS which equals the losses of all players that use SCS to gamble on the platform. However, at the same time, people who have their NFTs staked are earning SCS which either gets dumped pushing the price down or gets staked pushing the dividends down.

What used to be a 2$ weekly estimated earnings based on the small investment I made by now has gone down to 1.6$ because so much more SCS gets staked each week (+3.42% staked supply last week). The price of SCS would need to dip quite a bit more for me to add to my stake. Something I don't like is that they don't really share any details or updates on the USDC pool which in the end is what everything depends upon.

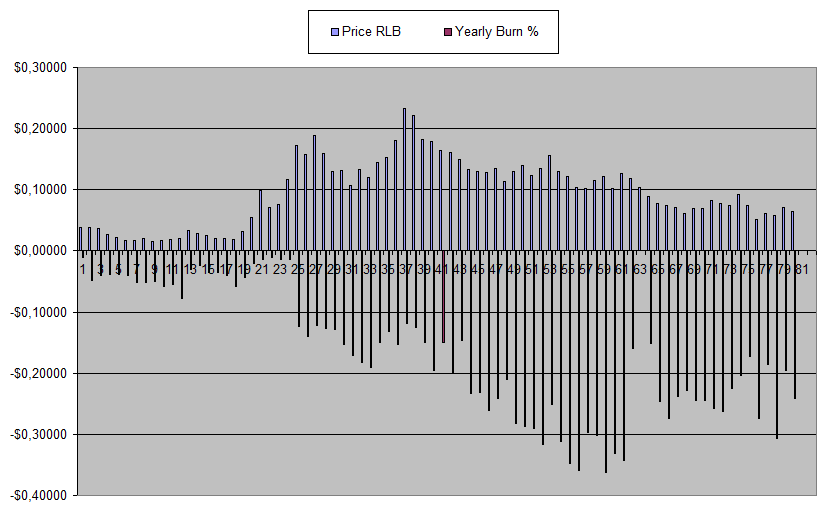

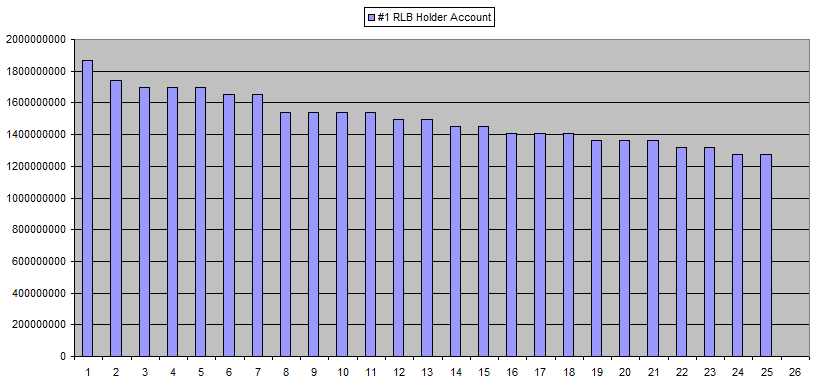

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

Something in me still really wants to get a bigger investment position in RLB and just hold that while seeing the supply getting burned. At the current pace, the supply over the course of a year will have gotten reduced by more than 20%.

At the same time however, it's very unclear how much of the supply Rollbit themselves hold. I have been tracking the biggest wallet on chain which still holds over 50% of the supply which has been going down systematically. I'm not sure however if these are just rollbit holdings which they are dumping keeping the price low or if these are customer funds that are deposited on the website.

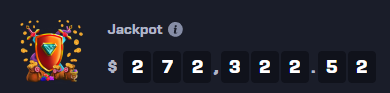

There is just too much centralisation risk and I mainly just stick to having the 2 NFTs I have left staked collecting the earnings from that and keeping it in RLB. In the meantime, the Jackpot has grown again to 272k Dollars which usually is the range it gets to before it finally is won by someone or a team.

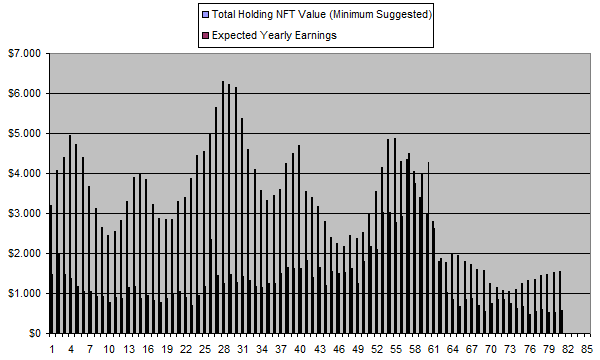

My 2 NFTs which at minimum suggested value are worth 1542$ paid out 11$ in earnings last week which equals 37% APY

I still need to change this chart as it's not fully representative given the fact that it included a Sportsbot which I was forced to sell due to forced KYC while nearly all countries are restricted making it that many use the platform with a VPN.

Sx.Bet (SX)

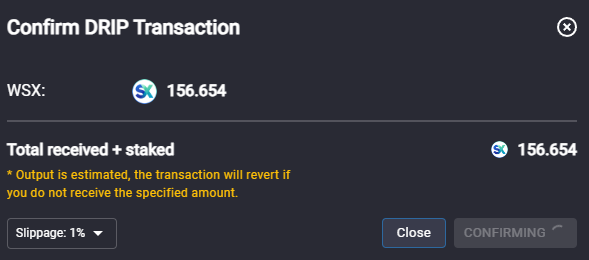

Everything seems to be merged properly to the SX Rollup and from the looks of it, volume is actually picking up. last week it was over 3 Million which I assume the US Open tennis which tends to be good for exchange trading has something to do with that along with the fact that there is an Arbitrum reward airdrop. However, the volume right now doesn't matter as fees are turned off and earnings are paid out with SX inflation. I also continue to have an issue with the site that it doesn't instantly connect to my metamask and I have to refresh a couple of times before it detects it and when claiming rewards it also doesn't pop up metamask to confirm. Only occasionally the site does properly connect instantly and allows me to claim. It probably would be fixed if I switch to another browser but I haven't bothered to do so yet because of the hassle.

Right now with the fees turned off, SX is basically useless while it gets inflated and everything relies on speculation how they will support real dividends later down the line.

While the project itself has the potential to be the crypto betfair, the tokenomics simply are horrible right now which fully reflects in the price. I'm also not really sure how much actual supply there is as part got burned

So yeah, there are certainly good things about this project as the actual product has a lot of potential but there is just too much hassle and the price isn't really performing.

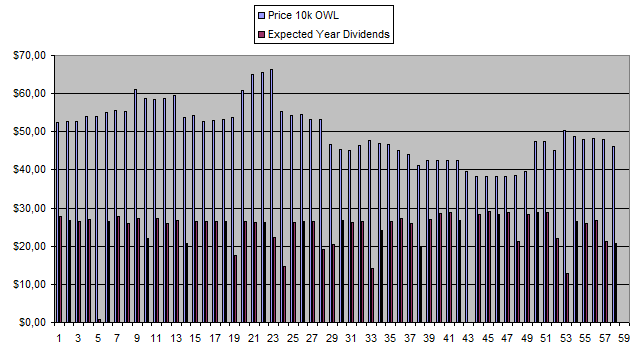

Owl.Games (OWL)

It was the 2nd week with lower dividends and I'm not sure if this is just the usual monthly delay in refilling the reward pool or if the pool was replenished with a lower amount as no more OWL was staked. I guess next week I will know more. I'm getting closer to having earned back half of what I put in so the risk on this one has certainly already decreased a lot.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 09/07/2024 | 600k | 3179$ | 2519$ | 33.17$ | 1294.26$ | 40.71% | +634$ |

| 16/07/2024 | 600k | 3179$ | 2519$ | 33.38$ | 1327.64$ | 41.76% | +667$ |

| 23/07/2024 | 600k | 3179$ | 2394$ | 25.35$ | 1352.99$ | 42.56% | +568$ |

| 30/07/2024 | 600k | 3179$ | 2673$ | 14.85$ | 1367.84$ | 43.03% | +861$ |

| 06/08/2024 | 600k | 3179$ | 2579$ | 30.66$ | 1398.50$ | 43.99% | +798$ |

| 13/08/2024 | 600k | 3179$ | 2544$ | 29.92$ | 1428.42$ | 44.93% | +793$ |

| 20/08/2024 | 600k | 3179$ | 2551$ | 30.78$ | 1459.20$ | 45.9% | +831$ |

| 27/08/2024 | 600k | 3179$ | 2546$ | 24.58$ | 1483.78$ | 46.7% | +850$ |

| 03/09/2024 | 600k | 3179$ | 2447$ | 23.93$ | 1507.71$ | 47.43% | +775$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

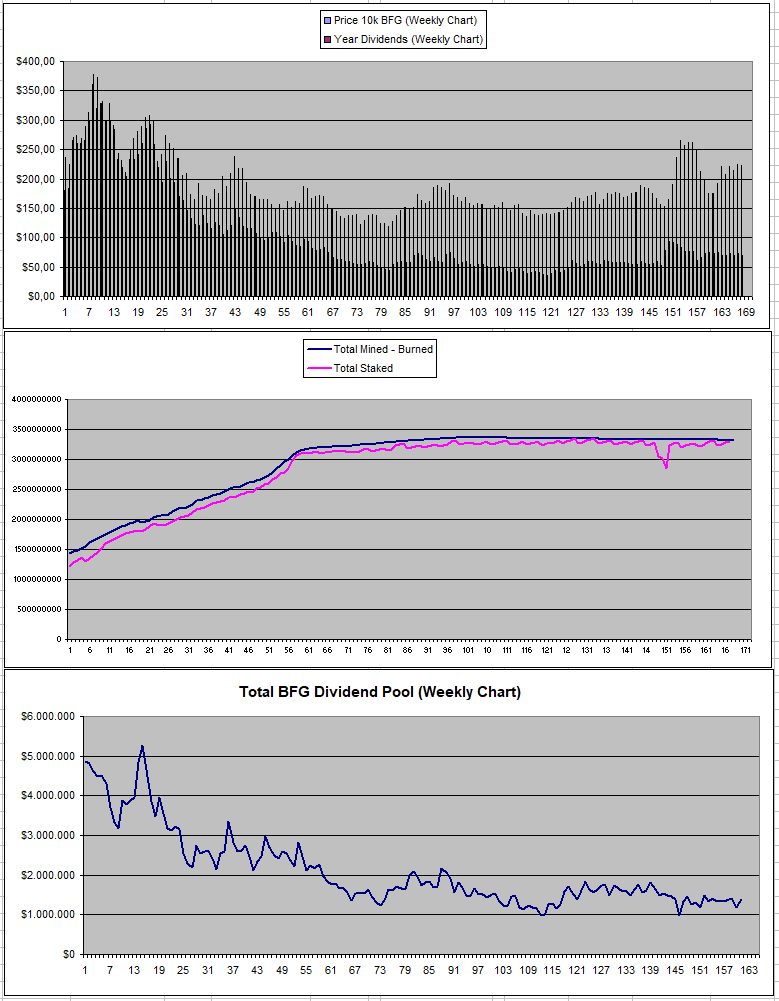

Betfury.io (BFG)

It looks like they did another update to the BFG tokenomics in an attempt to pump them. However, the only real thing that counts is to get the revenue up as the value of BFG pretty much based on 30% APY. If the payout goes up, the price of BFG will go up equally until it reaches around 30% again and if the payout goes down, the price of BFG will go down to the point where APY is back around 30%. This is at least how I see it, the risk is high which mean investors need to get a return equally to it. If return goes down there is incentive to sell and get out and if the return goes up there is incentive to buy.

Anyway, the new Tokenomics can be read Here. The way I understand it, nothing really changes and the main thing they try to do is to get the circulating supply down so less money is needed to pump or dump the price. The good thing is that the team is still active and they also partially rely on the Reward pool for their earnings.

In the end, it's fairly simple as everything just relies on the Dividend Pool and the overall revenue that the platform makes which hasn't gone up.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +55% APY |

| Betfury.io (BFG) | +31% APY |

| Rollbit.com (NFTs) | +37% APY* |

| Owl.Games (OWL) | +45% APY |

| Sx.Bet (SX) | +15% APY |

| WINR Protocol (WINR) | +3.72% APY |

| Solcasino (SCS) | +33% APY |

| VBookieSports (NFTs) | Soon |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

Personal Gambling Dapp Portfolio

I was a nice increase last week to ~350$ for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 26 Defibookie NFTs | 600k OWL | 26.4k SX | 75k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Are you ever use Freebitcoin?

If you do what is your opinion about that? If not check it out, have some interestings features like a 4% APR (0.0109% daily) in your Bitcoin if you have more than 30k satoshis.

Yeah I think @costanza was using it - he did a blog series on it: https://peakd.com/@costanza/freebitco-in-3-months-later-or-is-it-worth-it

yeah, I still have an account there and at times spin the wheel for free. I also think I reached the threshold to withdraw what I earned even though it's not that much. However, I wouldn't deposit money there to get 4% ARP. It's like picking up pennies in front of a freight train. The risk is just way too big to the reward. Betfury also offers way higher yields on BTC staking.

how to get SBET coin? you say it is on EOS but I cannot see it on Alcor...🤔

The only way to buy or sell SBET is on coinstore.com centralized exchange

It has a market maker and 1.85% of the total supply there so not much is needed to move the price up when buying or move the price down when selling especially when done in a 1-click. For me, it worked best to buy (or sell) in smaller batches to get most.

It remains one of the main downsides of SBET, the dividends have been excellent and super reliable for a very long time now in order to actually get invested you need to go out of your way and it's not for the average user. Once you have everything in place it is all very easy. The ood thing is that it's easy for gamblers to sign up and use the platform in a centralized way but they are held back by being on an unpopular chain. That said, everything does work very well but it's hard to see massive adoption and it's not without risk even though it has a solid history.

Good Luck!