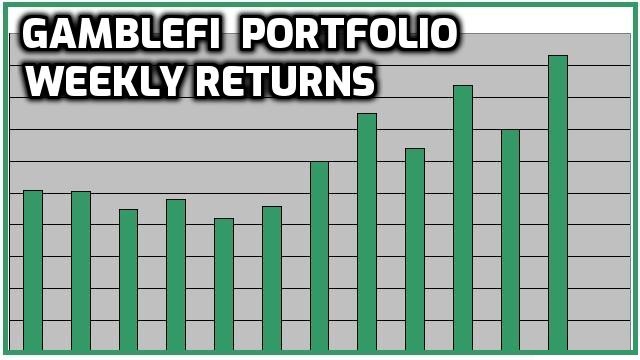

GambleFi Portfolio | High SBET Returns & Defibookie Airdrop!

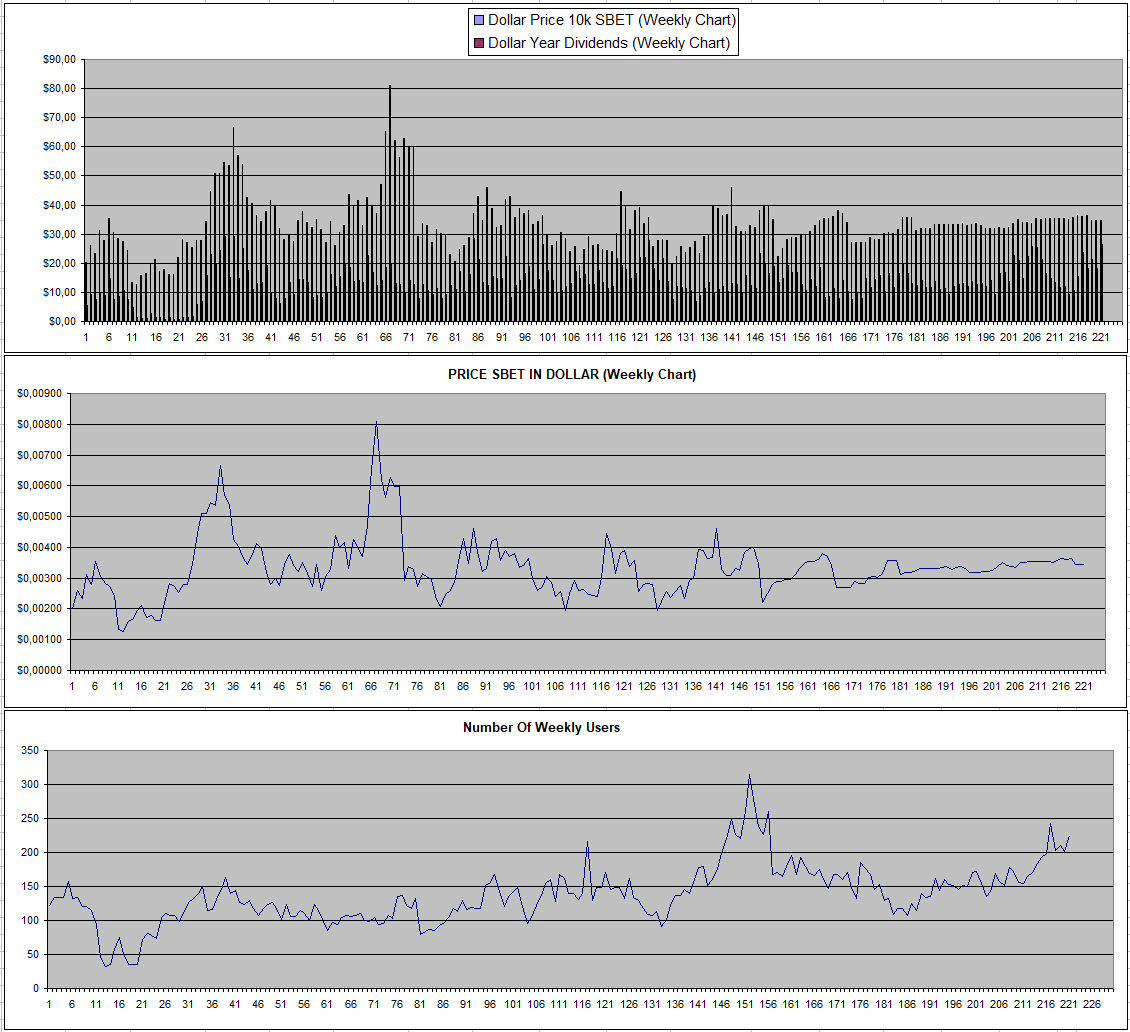

Sportbet.one (SBET)

It was an excellent week for Sportbet mainly thanks to 1 Whale despite the international break week. The price of SBET hasn't moved wich made the APY based on the returns last week a massive 76.85%. If I wasn't in already quite deem, I would buy more at this point. There is however still a long way to go and I would be surprised if the dividends of this week from now on would be the norm.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

Last week I started including the on-chain data of the biggest RLB wallet on ETH suspecting that Rollbit is dumping coins which is holding the price down while also doing the buy & burn. There recently was an AMA where one of this things which was stated is that the RLB Solana conversion toward RLB on ETH will end soon making everyone who didn't convert lose their stake. I guess a large part of the main wallet going down is people converting from Solana to ETH.

This week there was also a change where KYC was obligatory to stake in the RLB lottery and I assume also to stake NFTs but from the looks of it this was removed again. What I assume is that they know that many of their customers use VPN as many countries are restricted which gives potential regulatory issues. At the same time they make up a large part of their revenue so it's a double-edged sword. The KYC requirements did have a big effect on the RLB price which dumped.

It remains the main issue with these fully centralized crypto bookies and you have to hope they are honest about the actual revenue and pray they give your money back if you ask especially when you use a VPN to access the site either to gamble or to invest.

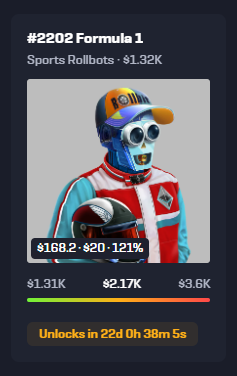

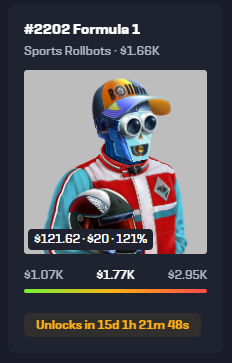

The international break also made the Sportbot revenue share go down quite a bit as expected. I assume with the KYC, many also are forced to sell which brings prices that NFT's go for on the market down again to a point where they offer really high APY.

| Last Week | This Week |

|---|---|

|  |

The KYC dump dropped the price below the Long-term support line for a moment but at the moment it's back up. The main issue for RLB I see is that either you have to buy it on ETH which has crazy high fees which might go up as the bull market progresses or you need to buy it on the centralized rollbit site hoping they give your money back which isn't a given looking at some of the reports on Twitter.

The returns on the NFTs are also really hight thanks to my sportsbot and I continue to re-invest everything on the site into RLB

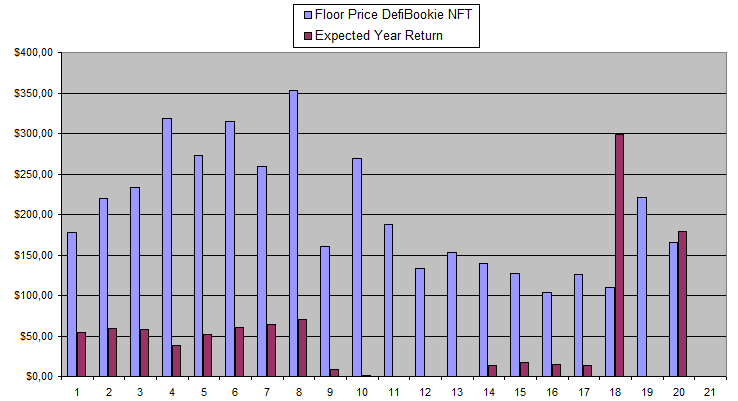

Defibookie (NFTs)

Despite no revenue share this month, it was a great week for Defibookie as they partnered with Bored Ape Solana Club with their holders getting Free bets (72k worth of them) while Defibookie holders are getting a BASC airdrop. The main hope is that part of the people who get free bets continue to gamble on the site increasing the volume and earnings.

My 13 staked NFTs resulted in 40 BASC (44$) while more drops are coming in the next 6 days.

I guess this was the reason why NFT's went up in value last week. I'm still kind of tempting to but more at the current price as likely more of these airdrops will come while at some point the actual revenue share will return.

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 207$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 188$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

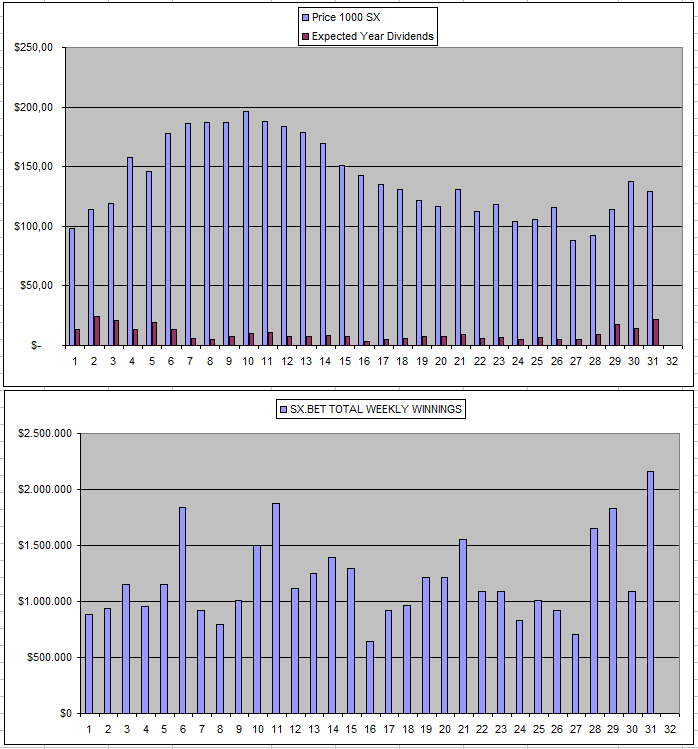

Sx.Bet (SX)

There was an increase in volume last week I guess as Arbitrum is now a supported chain making things more accessible. The dividends now also are at 10$+ weekly but it fully comes from inflation so it's fairly easy. At the same time, I see it not as unlikely for SX.bet to become the crypto betfair over time. In that regard, I'm tempted to buy more. I also just like the team and the progress that has been made over the years. At the same time there is a 100 Million+ Valuation already while this simply is not supported by the actual revenue and activity.

Owl.Games (OWL)

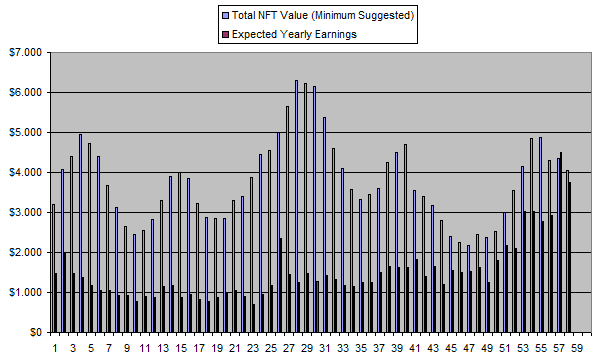

Owl stays pretty straightforward with the same expected returns in dollar value while every 3 weeks this drops because they are late on refreshing the pool and nothing really happening aside from this.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -67$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +225$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188$ |

| 24/10/2023 | 500k | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +248$ |

| 31/10/2023 | 600k | 3179$ | 2947$ | 19.95$ | 279.71$ | 8.80% | +48$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 14/11/2023 | 600k | 3179$ | 2796$ | 30.55$ | 340.69$ | 10.72% | -42 |

| 21/11/2023 | 600k | 3179$ | 2813$ | 30.65$ | 371.34$ | 11.68% | +5$ |

| 28/11/2023 | 600k | 3179$ | 2824$ | 30.53$ | 401.87$ | 12.64% | +47$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 12/12/2023 | 600k | 3179$ | 3221$ | 30.42$ | 452.46$ | 14.23% | +494$ |

| 19/12/2023 | 600k | 3179$ | 3445$ | 30.14$ | 482.60$ | 15.18% | +749$ |

| 26/12/2023 | 600k | 3179$ | 3475$ | 30.40$ | 513.00$ | 16.14% | +809$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

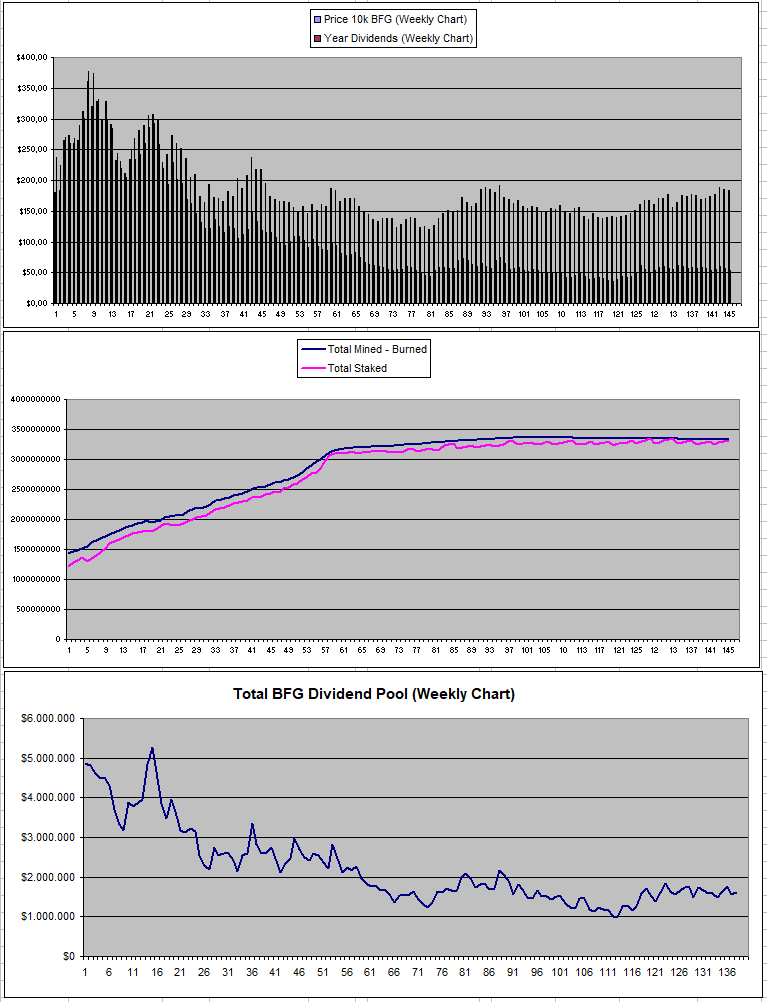

Betfury.io (BFG)

BFG remains pretty flat with reliable dividends.

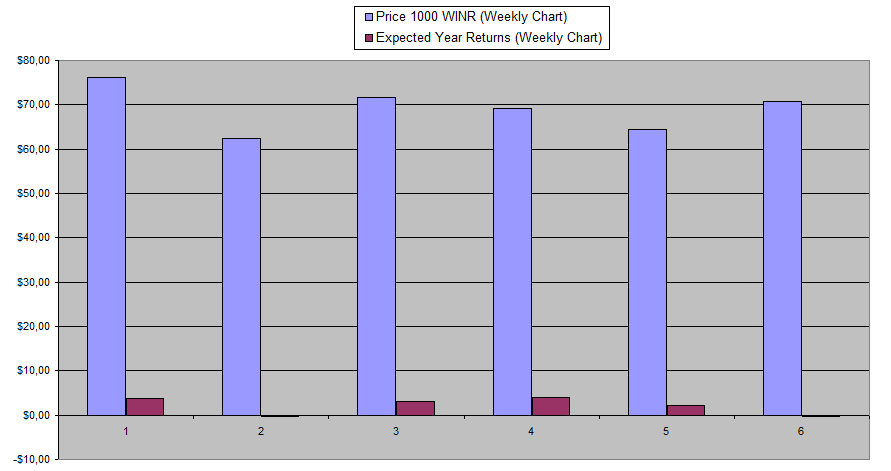

WINR Protocol

This was the 2nd week where there was a loss for WINR and the platform continues to mostly confuse me being too complicated.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +76.85% APY |

| Betfury.io (BFG) | +29.35% APY |

| Rollbit.com (NFTs) | +92.69% APY* |

| Owl.Games (OWL) | +57.09% APY |

| Sx.Bet (SX) | +17.17% APY |

| Defibookie.io (NFTs) | +107.83% APY |

| WINR Protocol (WINR) | -0.41% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

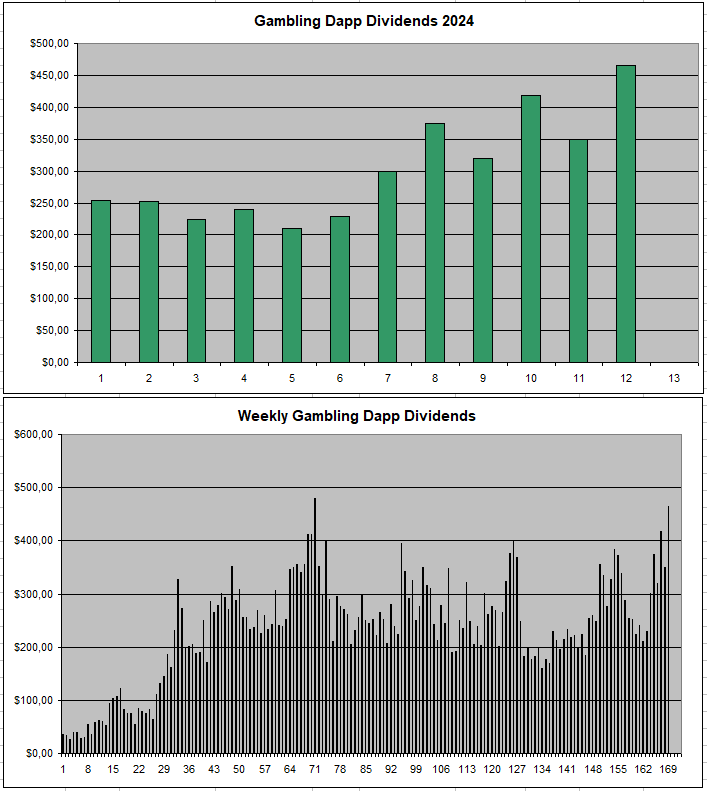

Personal Gambling Dapp Portfolio

This was my 2nd biggest earnings week ever earning 465$ in a week for holding 5M SBET | 500k BFG | 3 Rollbot NFTs | 600k OWL | 25k SX | 13 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted using Bilpcoin

Via Tenor

Credit: burn-cent

Earn Crypto for your Memes @ HiveMe.me!

great research ! i've used to hunt these type of opportunities and made a nice profit on it ... until their site went down. my advise is to make a good exit plan and don't wait too long to execute it. afterall its a "gamble" eh. Good luck

If anything, I'm very aware of the risks and it's also the reason why the returns are so high. Which one did you get into that rugpulled ?