GambleFi Portfolio | Exploring Solcasino.io (SCS)

I continue to look for more projects to grow and diversify my GambleFi Portfolio which is aimed at bringing in passive earnings. Ever since I got into the solana ecosystem with Defibookie.io I'm also discovering other projects there. One of them is Solcasino.io which both has NFTs and a token for Revenue share.

Defibookie (SCS)

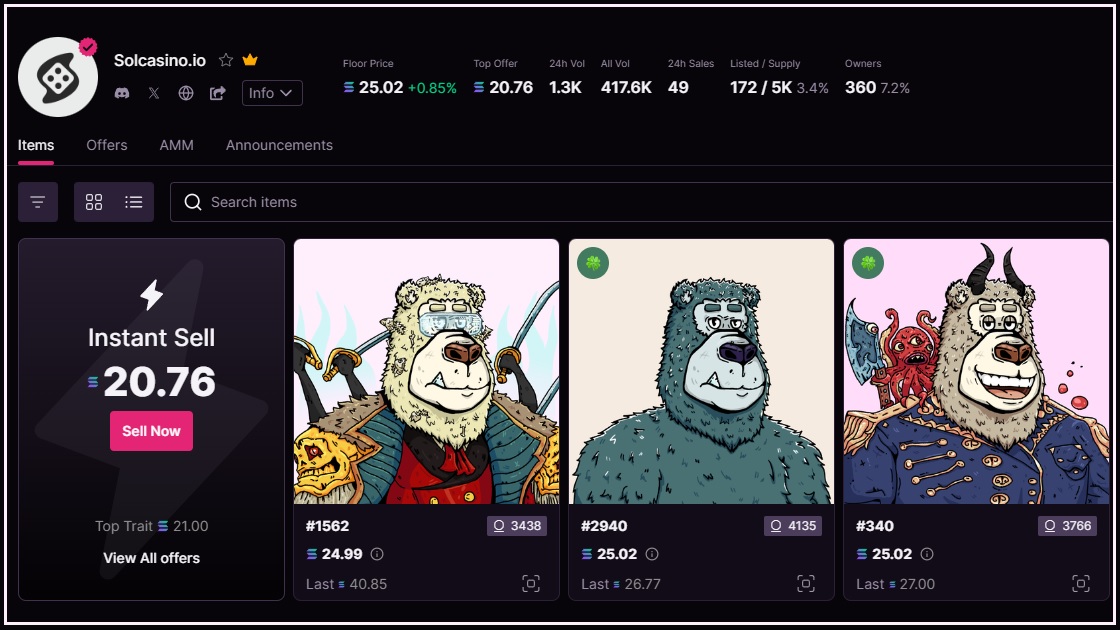

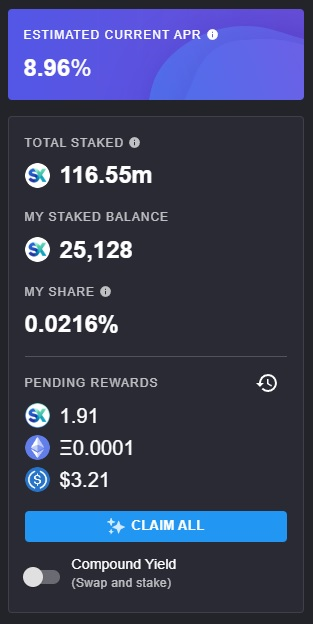

I have been following the events the past weeks trying to figure out if it's worth it for me to get some SCS and add it to my portfolio. To give a brief summary, I assume Solcasino is using OwlDao as their casino provider as it all looks and feels identical. They seem to be by far the biggest casino that aims to get users on the Solana blockchain. They have NFTs of which there are a total of 5000 and they also have a SCS token which similar to Owldao generates earnings based on (I Think) 40% of the casino profit. There was a mint of their NFTs and one of the things that gives it value is the fact that locking it generates SCS. This SCS can be staked to get passive earnings.

It's a model where it's easy to give tokens and NFTs a lot of value at the start since there is little SCS in circulation at the start meaning that the APY on the casino revenue is way bigger compared to the full supply. Over time there is crazy inflation which is bound to crash the prices. This is also what happened with Betfury and many others. It's a great way to kickstart things as there are good incentives for players to gamble but at some point in time the price needs to be paid.

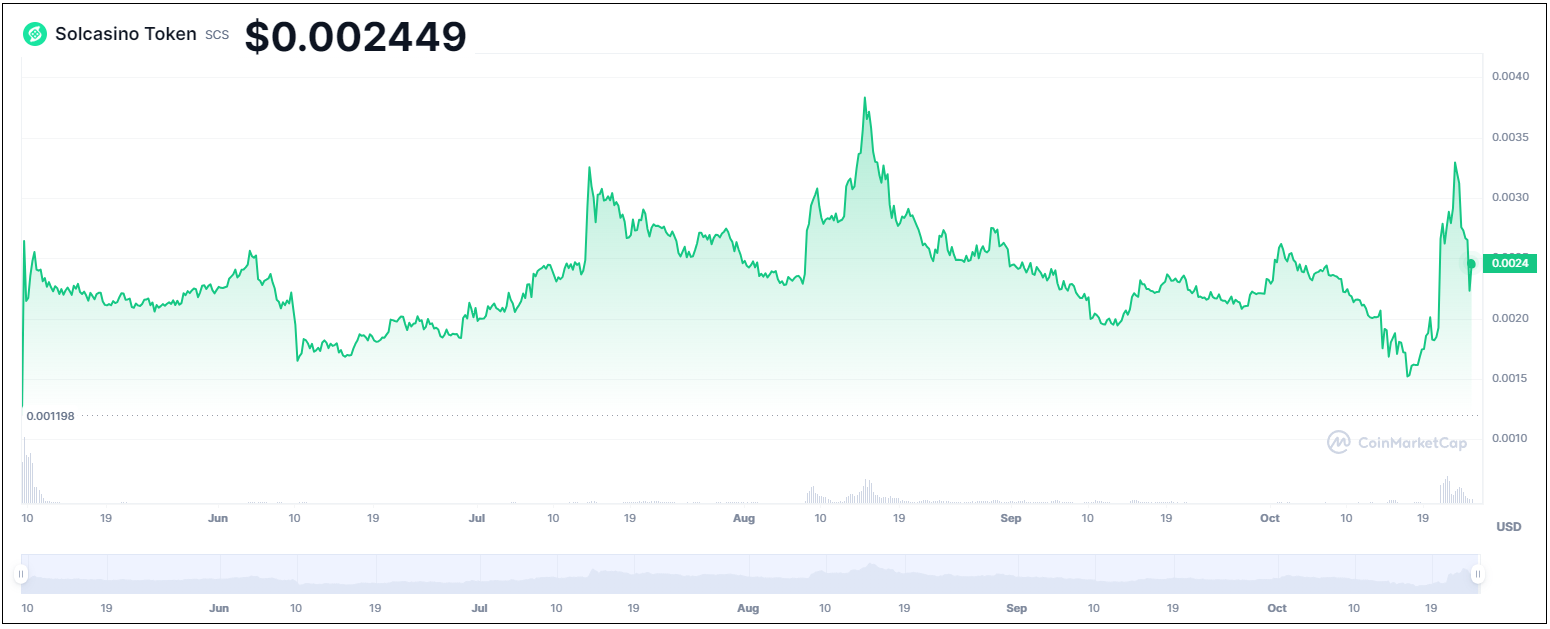

Everyone who got in at the start I believe did really well with this projects getting their mint price back and a lot more. However, devs didn't like the vact that the SCS price was in decline these past monts since everyone holding an NFT was dumping their SCS. So they made big changes pretty much directly taking value from NFTs and transfering it to SCS at least in a short term pump. Now it's not only needed to stake and NFT but SCS also needs to be staked in order to get SCS along with the obligation for stakers to bet at least 1$ a week on the casino.

This crashed the NFTs and pumped the SCS price since and not everyone in the community was happy with this to say the least. in a reaction the team also burned the team supply, unused community rewards supply, & the unused Liquidity Supply which combined equals 27% of the max supply.

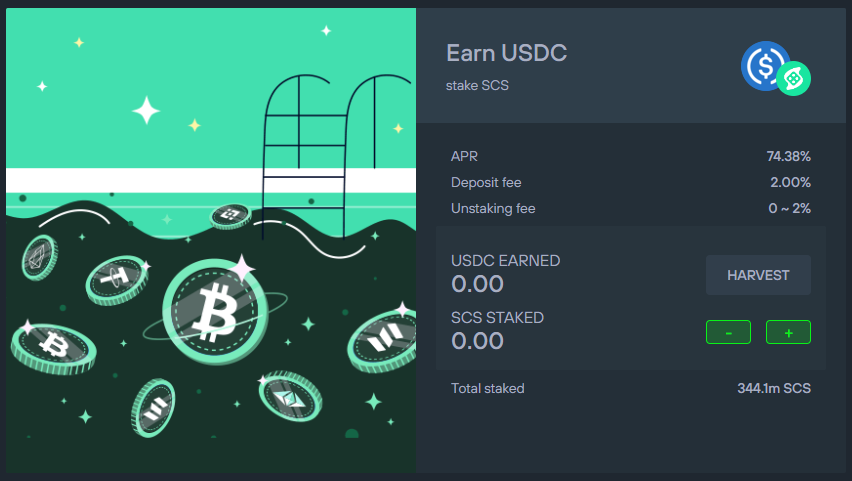

The fact remains that right now only 344M out of 73 Billion max supply is staked to get dividends and 74.38% APY nearly isn't covering the likely decline in price as more tokens get in circulation. The fact that the team just makes major changes like that screwing everyone that bought their NFTs on the market in order to pump the scs price also isn't something I don't really like.

This said, their casino seems to do quite well overall as the solana ecosystem has been used properly as a marketing gimmick attracting those users. My hope was for openbetai to achieve something similar to this but that didn't really work out.

Anyway, in the end the only real thing that counts is the revenue these projects make compared to the fully diluted marketcap along with the grow potential and the reliability of the team. Solcasino for me just falls short of this and I do expect the high inflation to continue to outpace the growth in revenue so I'm skipping on this one for now.

Defibookie

If everything goes right, there should be a revenue share early in November based on the numbers of October. Still more info needs to be released on the NFTs and the revenue share but it has been dropped that having multiple NFTs from the same team should give extra benefits. I'm keeping an eye out to buy some more based on ones I already own to potentially stack a team. The mint price was around 110$ with golden foils being worth twice that. Unfortunately I didn't get any of those with my 12 mints.

I did buy 1 extra NFT and might get a couple more along the way. There are however a couple red flags as I have been using the bookie and from the looks of it right now it should be extremely easy to beat since they are very late on adjusting some lines. It also seems that they are accepting parlays on the same team which all other books don't allow as it gives an unfair edge.

The floor price in SOL went down as SOL price increased with +50% last week. However, the floor price is still higher compared to the mint price in dollar. I do expect the first revenue share to spark more interest but I will see how it goes the coming weeks.

Sx.Bet (SX)

Not all too much is happening with SX which still ranges around 1M in total winnings weekly and 70k SX being rewarded to players. The number of SX staked remained the same but there now is 1 less validator.

I also tried to convert USDC on the SX network back to Polygon but there seems to not be enough in the pool right now. I asked about it in their discord and it will get refilled they say

The NBA season starts soon which might see some more volume coming in.

Owl.Games (OWL)

Owl continues to pay good dividends but the price of the token seems to be fully disconnected from the crypto space as it stayed flat and even went down a bit. I'm still tempted to buy some more but haven't gotten around it yet.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82.1$ |

| 15/08/2023 | 400k | 2084$ | 1867$ | 20.40$ | 42.3$ | 2.03% | -171.1$ |

| 22/08/2023 | 400k | 2084$ | 1911$ | 20.80$ | 63.1$ | 3.03% | -106.3$ |

| 29/08/2023 | 400k | 2084$ | 1950$ | 0.55$ | 63.6$ | 3.05% | -66.7$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115.1$ |

| 12/09/2023 | 500k | 2636$ | 2454$ | 26.77$ | 110.67$ | 4.20% | -71.33$ |

| 19/09/2023 | 500k | 2636$ | 2449$ | 25.00$ | 135.67$ | 5.15% | -51.33$ |

| 26/29/2023 | 500k | 2636$ | 2699$ | 26.17$ | 161.84$ | 6.14% | +224.84$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +146.99$ |

| 10/10/2023 | 500k | 2636$ | 2582$ | 26.1$ | 209.09$ | 7.96% | +155.09$ |

| 17/10/2023 | 500k | 2636$ | 2590$ | 25.05$ | 234.14$ | 8.88% | +188.14$ |

| 24/10/2023 | 500l | 2636$ | 2624$ | 25.62$ | 259.76$ | 9.85% | +247.76$ |

** the High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

RLB is very much connected to the crypto space and started to go up again which made me cost-average out of the coins I bought lower a in the past month. I hope it will continue to go up and down so I can repeat this cycle a couple of times. I did take out some funds in order to buy 1 more defibookie NFT.

Sportbet.one (SBET)

SBET had another really solid week with a 1% return based on the current price of SBET.

Betfury.io (BFG)

BFG wasn't fully able to continue to good momentum but the general crypto price increase should help a bit toward next weeks dividends.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +51.58% APY |

| Betfury.io (BFG) | +29.09% APY |

| Rollbit.com (NFTs) | +36.22% APY |

| Owl.Games (OWL) | +44.85% APY |

| Sx.Bet (SX) | +4.13% APY |

| Defibookie.io (NFTs) | Soon |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own.

Personal Gambling Dapp Portfolio

I was back above 200$ last week earning 253$ for holding 5M SBET | 500k BFG | ~3454$ worth of Rollbot NFTs | 500k OWL | 25k SX |1400$ worth of DefiBookie NFTs . I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Yes, gambling has a long history as a business. Setting aside the moral aspect, a gambling protocol can provide stable earnings if it has a reliable structure and manages to gain public trust."