GambleFi Portfolio | Dividend Cooldown

Dividends now have cooled down a lot a 2nd week in a row and I'm hoping it's just because of the lack in Sports aside from the Olympics which I assume not that many people bet on. Soon all the football leagues will start again and the NFL also and things likely will pick up again.

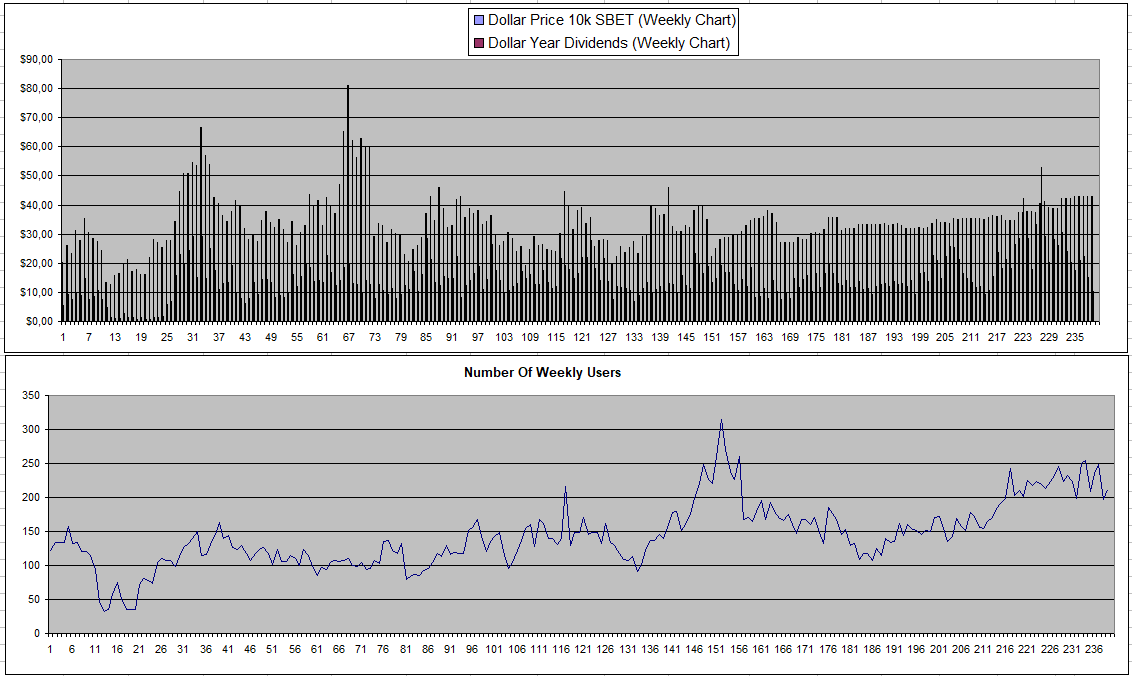

Sportbet.one (SBET)

While the price of SBET has stayed the same, the dividends and returns were the lowest in a long time last week at 24%. This kind of makes sense as they heavily rely on Sports Betting action. The number of users however didn't see a major drop off.

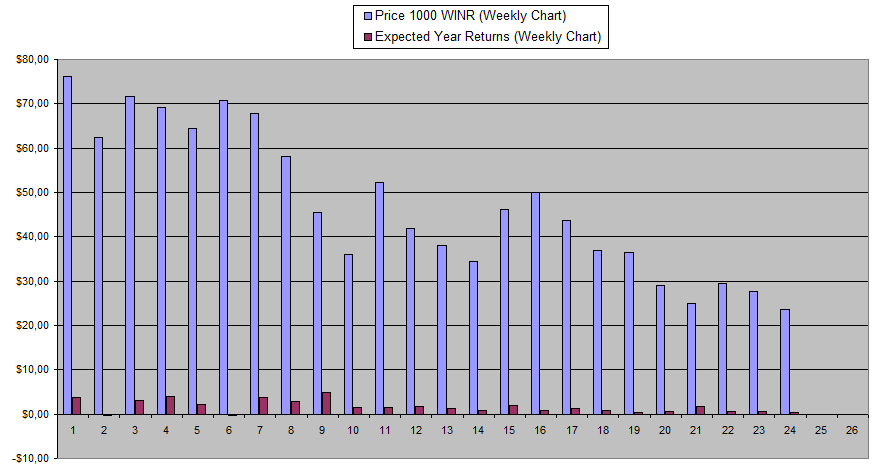

Winr feels like one of those projects where the tech is actually there but the users are not which is at least equally as hard. So the main question going forward is of they actually can attract them one way or another. The Price of WINR also continues to go down now at 0.0211$ wich either is a great opportunity or buying into a project that will never take off. Afterward it's always easy to tell and say if only I stacked up like crazy but at the moment self, the fear, uncertainty and doubt just is massively big. I'm not sure if I want to add to my bags or just leave them where they are.

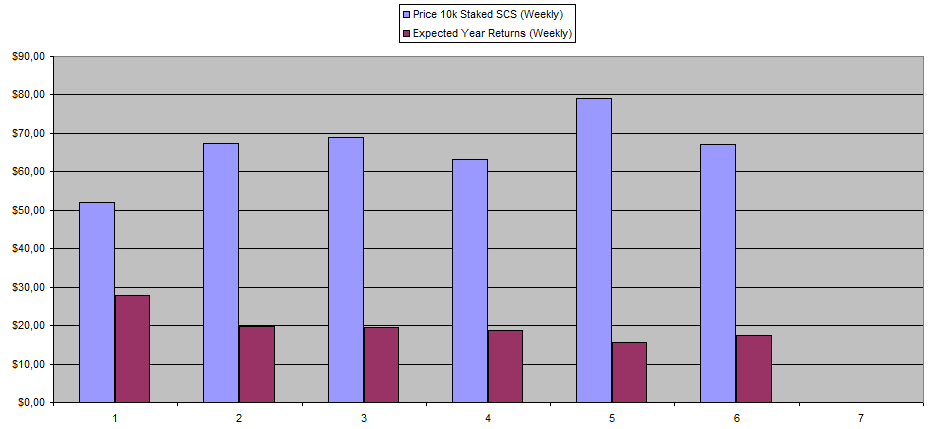

Solcasino.io (SCS)

Not much excitement around SCS and the staked SCS pretty much continues to go up week after week which puts pressure on the returns unless they increase the USDC Pool. With this inflation it's going to be hard to really reach higher dividends or price increase realistically aside from maybe a temporary pump. The supply in total since I first staked 6 weeks ago went from 287M to 355M so a +24% increase. At least some SCS is getting burned when staking and unstaking. For now I just keep the little bit that I have as an experiment.

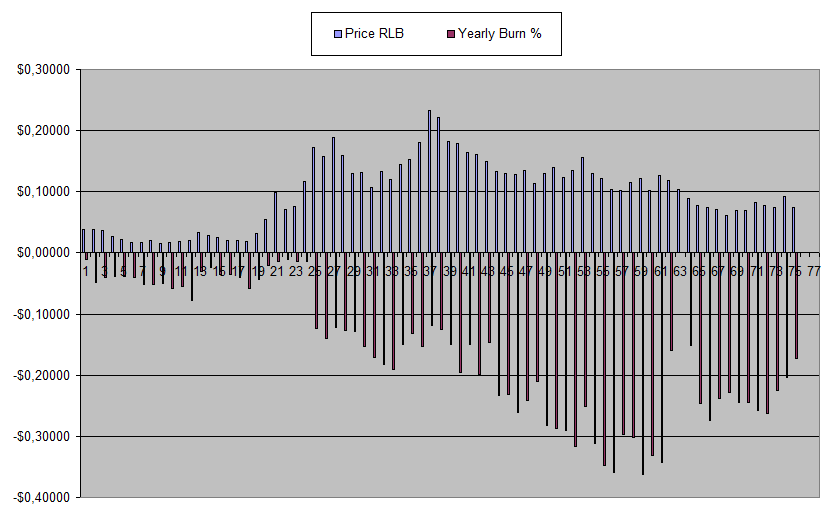

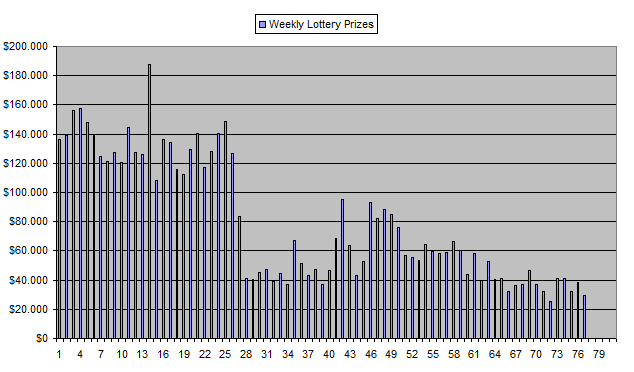

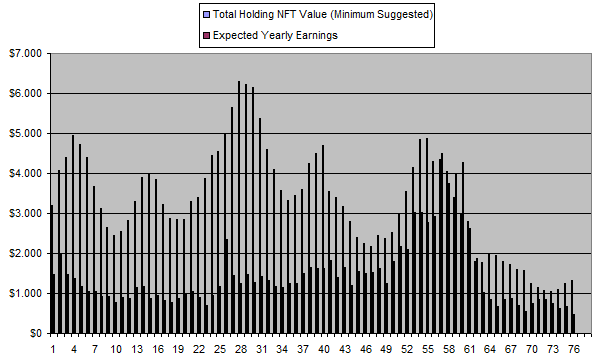

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

There is an overall downtrend in site revenue for Rollbit and the RLB Yearly burn expectation has gone down from over 35% to now around 17%.

One of the numbers this also reflects in is the weekly lottery prizes which kind of directly reflect revenue made.

The hype around rollbit is also fully gone and the only real way for it to get back is for RLB to pump hard. It is one of those cases where price action drives adoption and not the other way around and it's difficult to achieve. In the end they are still making good profit (or so they claim) and each day more RLB gets burned with the total market cap sitting below 200M. So not bad at all.

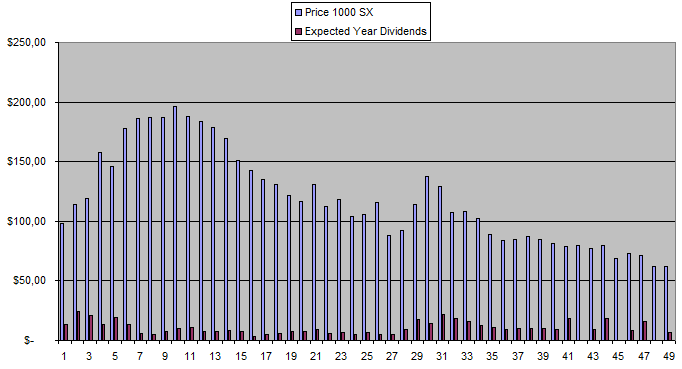

Sx.Bet (SX)

SX is acting the same difficulty as WINR as not enough people use it with the added handicap that the product actually needs more users to get better since you want to have liquidity to bet. With limited users you are down taking the offered odds which aren't better compared to what is available out there while when putting in an offer at a good price you are not sure to have it filled. This is the reason why I personally prefer just regular bookies over lower liquidity exchanges.

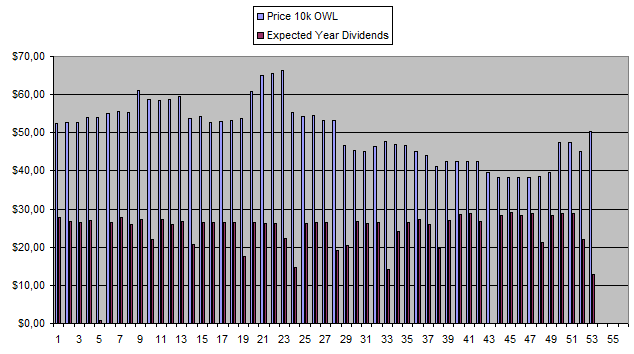

Owl.Games (OWL)

The good thing is that the price of OWL was up again a bit but dividends were again lower as likely the refilling of the pool happened with the usual delay this time in between claiming them. I'm now up +861$ after 36 weeks in this project which is around 24$ a week or a +39% average APY.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

| 09/07/2024 | 600k | 3179$ | 2519$ | 33.17$ | 1294.26$ | 40.71% | +634$ |

| 16/07/2024 | 600k | 3179$ | 2519$ | 33.38$ | 1327.64$ | 41.76% | +667$ |

| 23/07/2024 | 600k | 3179$ | 2394$ | 25.35$ | 1352.99$ | 42.56% | +568$ |

| 30/07/2024 | 600k | 3179$ | 2673$ | 14.85$ | 1367.84$ | 43.03% | +861$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

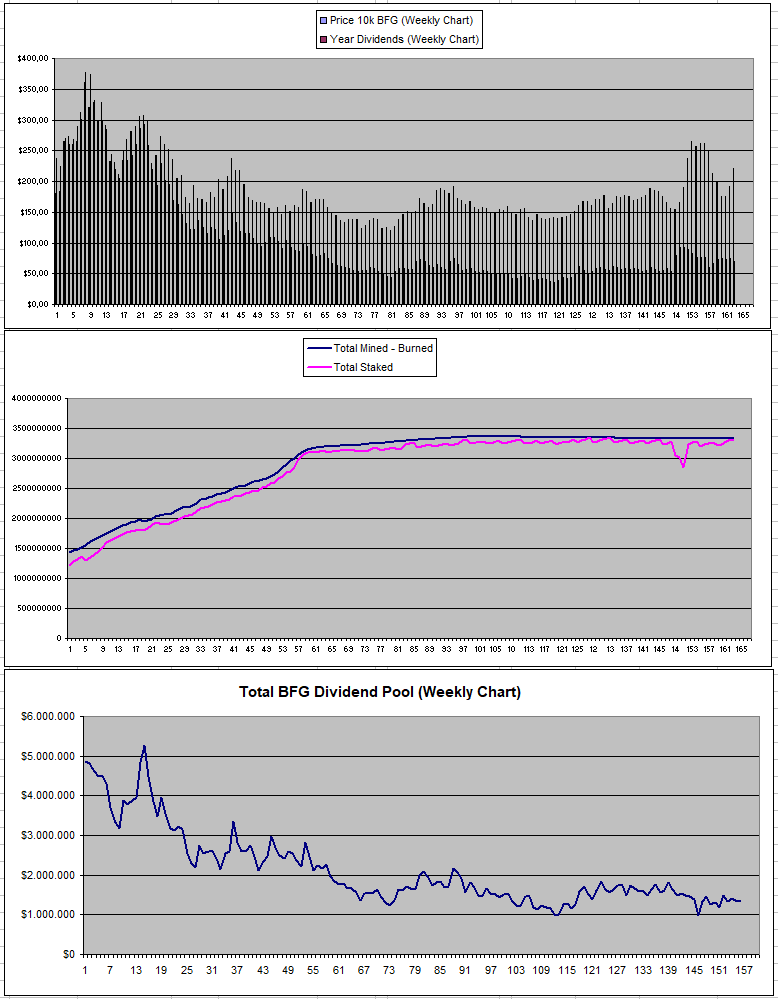

Betfury.io (BFG)

BFG returns stay more or less flat at a decent APY but in the end the price and dividend increase over time is what I mostly hope for. So far there hasn't been an increased adoption to make this happen.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +24% APY |

| Betfury.io (BFG) | +31% APY |

| Rollbit.com (NFTs) | +36% APY* |

| Owl.Games (OWL) | +25% APY |

| Sx.Bet (SX) | +11% APY |

| WINR Protocol (WINR) | +1% APY |

| Solcasino (SCS) | +26% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

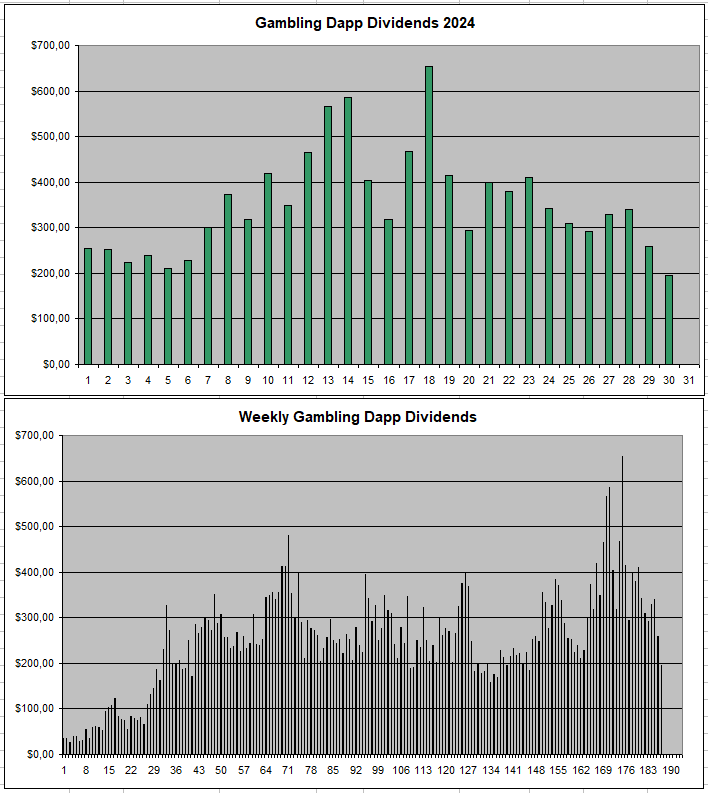

Personal Gambling Dapp Portfolio

All this delivered me under 200$ (195$ to be exact) for the week which was the lowest of the last 40 weeks. I'm holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 20k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Congratulations @costanza! You have completed the following achievement on the Hive blockchain And have been rewarded with New badge(s)

Your next target is to reach 2900 posts.

You can view your badges on your board and compare yourself to others in the Ranking

If you no longer want to receive notifications, reply to this comment with the word

STOPCheck out our last posts: