GambleFi Portfolio | Bought Some More WINR!

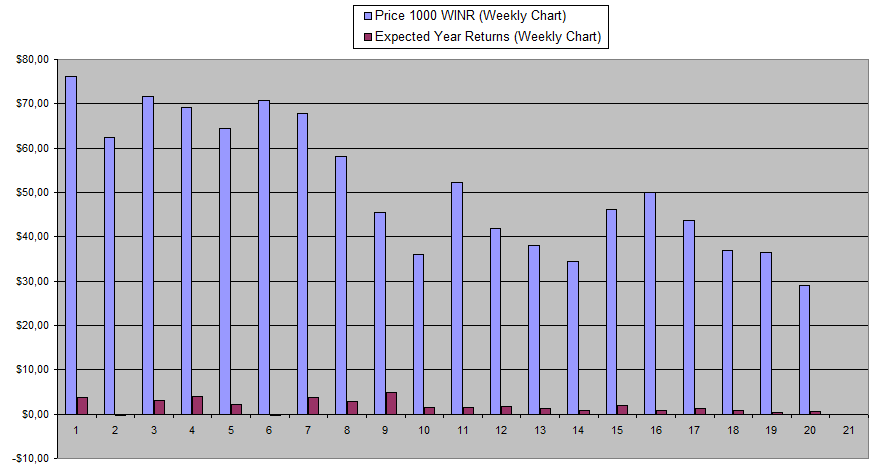

I bought some initial WINR 21 weeks ago just to have a small stake in the platform and track the results, the returns have been disappointing and the price ever since came down by more 65% while I initially bought at a close to 50% discount compared to the all-time high.

So pretty much it has been downhill with limited to no real adoption and a just too complicated platform. However, I still like the idea behind all of it and they soon will launch the WINR chain which similar toSX network will make it possible to bet with limited to no transaction fees. They also launched their version of Sweet Bonanza which is a popular slot machine on casino sites.

I did test te platform and it all works properly. I do see value in a casino where everything operates on chain in a verifiable fair way and Winr to me seems to be the infrastructure that does this in a similar way how sx network does it for Sports betting. There is also a release of a sportsbook coming form Winr even though I doubt the odds will be anywhere near competitive as the priority will be on making sure the treasury stays healthy. It also looks like a new dashboard is coming.

at 0.027$ now for WINR, the fully diluted market cap now is around 11 Million. The revenue in no way right now justifies this so it is mainly a gamble on potential future revenue. I now have 20k WINR at an average price of 0.52. I still need to figure some things out what the difference is between staking and vesting as the entire platform remains highly confusing. I hope to get that done by next week so I properly can continue to track how things go. I do need a lot more conviction in order to buy more from here on out though.

Solcasino.io (SCS)

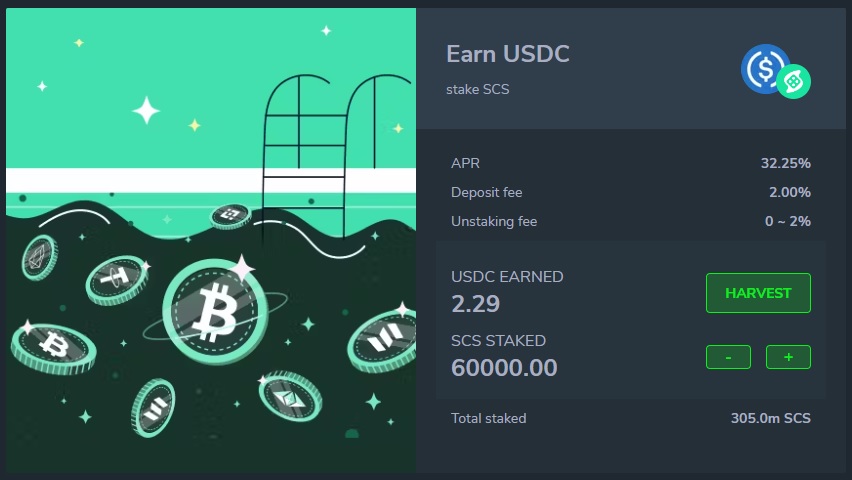

IIt looks like having staked 60k SCS gave around 2.29$ in passive earnings last week.

The price of SCS also started to go up with still quite some way to go before I sell half my stack which I keep in my wallet unstaked. I did pay 657$ for the 120k SCS I have at an average price of ~0.0055$ so the moment SCS reaches 0.011$; I will sell 60k to have a free bag. in case it would dump more I might consider adding some more.

In the coming weeks I will also have a proper chart of Price SCS vs Yearly expected returns.

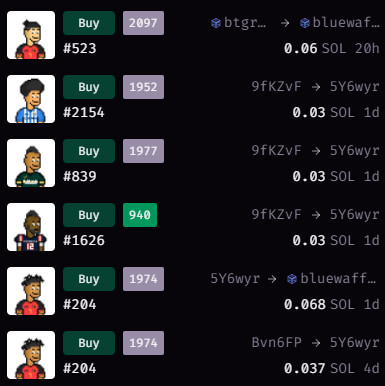

Defibookie (NFTs)

I consider Defibookie as rugged by the devs even though there is still a window that the project will continue one way or another, if it ever comes back or if I see something from my NFTs I will update on it. There is still being speculated on NFTs but I rather see them go to zero than sell for 0.05 SOL.

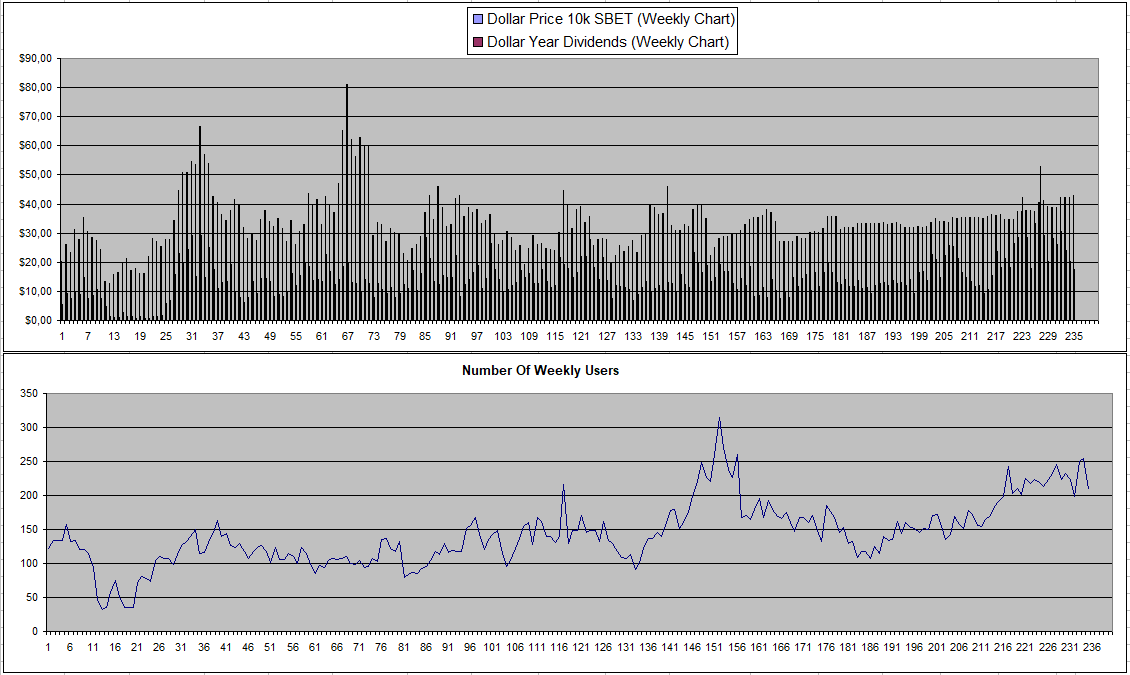

Sportbet.one (SBET)

Yet another reliable week for SBET with ok dividends

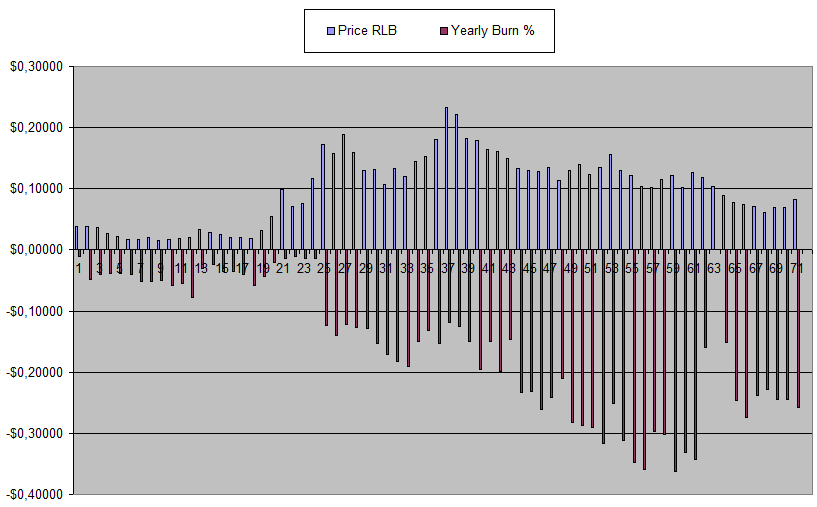

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

Things seem to be stabilizing for RLB and the price actually started gong up again.

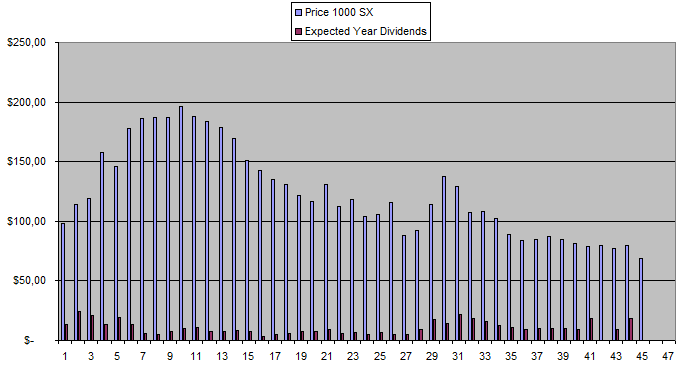

Sx.Bet (SX)

As expected, no dividends this week from sx as last week they were double. With the earnings paid out in inflation, the sell pressure is starting to weigh on the price of SX which is making lower lows.

Today there was a review of Q2 which can be read Here). what I get from it is that there is some growth but the switch to 0% fees which was supposed to be 4 months as a promotion seems to be a permanent thing with them finding new ways to give SX value. What they plan is to have a 2% fee for cross-chain bettors who choose for convenience. A re-introduction of a taker fee might also be turned on again and lastly they are looking to launch an on-chain casino

So i expect it to take more time for the earning to potentially come from real revenue again with possibly more pressure on the price. If it would go drastically lower, I would consider adding a bit to my bag.

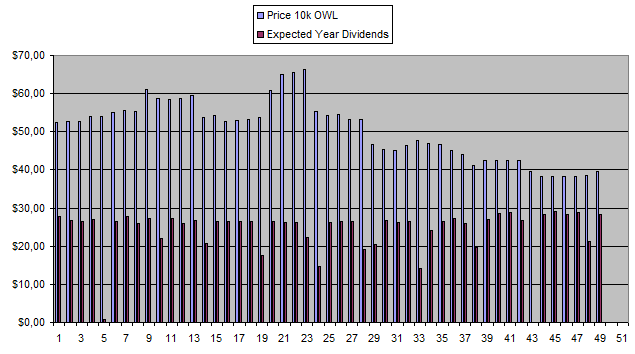

Owl.Games (OWL)

Stability without actual growth seems to be the name of the game for Owl and I keep earnings back what I put in at a slow pace week after week.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

| 04/06/2024 | 600k | 3179$ | 2035$ | 33.48$ | 1137.97$ | 35.79% | -6$ |

| 11/06/2024 | 600k | 3179$ | 2035$ | 32.60$ | 1170.57$ | 36.8% | +27$ |

| 18/06/2024 | 600k | 3179$ | 2029$ | 33.22$ | 1203.79$ | 37.86% | +53$ |

| 25/06/2024 | 600k | 3179$ | 2039$ | 24.55$ | 1228.34$ | 38.64% | +88$ |

| 02/07/2024 | 600k | 3179$ | 2098$ | 32.75$ | 1261.09$ | 39.67% | +180$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

Betfury.io (BFG)

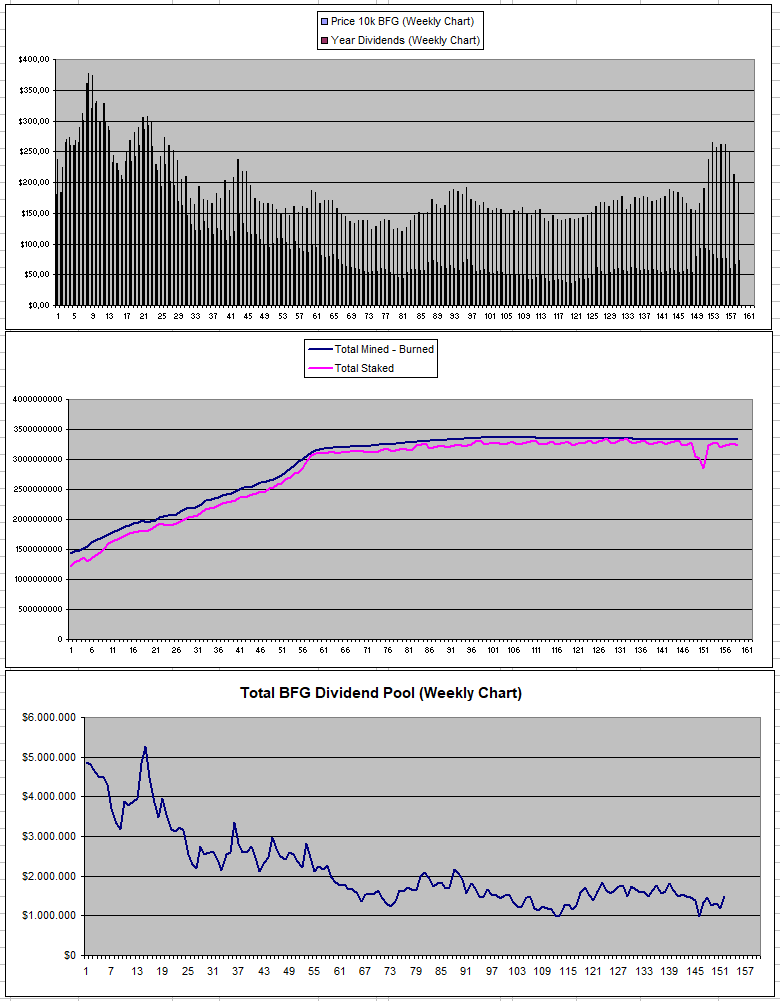

It was a surprisingly good week for BFG with another increase in dividends again while the price of BFG started to go down again after the initial pump which happened because of the staking. In the end, the only thing that really counts is the dividend pool which seems to be stable at somewhere between 1M and 2M.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +41% APY |

| Betfury.io (BFG) | +37% APY |

| Rollbit.com (NFTs) | +78% APY* |

| Owl.Games (OWL) | +71% APY |

| Sx.Bet (SX) | +0% APY |

| WINR Protocol (WINR) | +2.26% APY |

| Solcasino (SCS) | +28% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

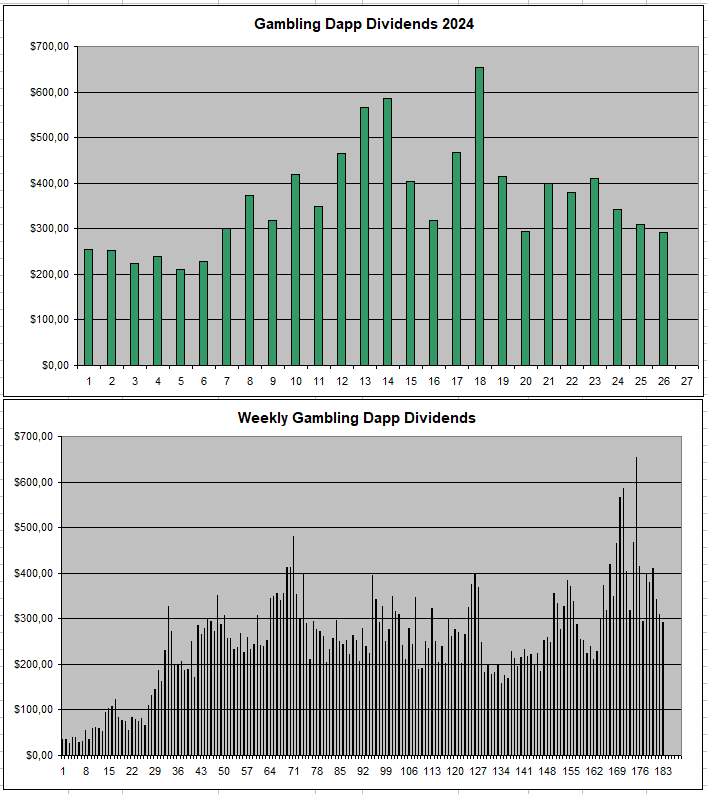

Personal Gambling Dapp Portfolio

I'm back just below 300$ in earnings last week for holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 10k WINR | 60k SCS. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|

Play2Earn Games that I am Playing...

|  |  |

|---|

Keep up the good work. 👏🎵

Dear beloved Hive creator,

Coding poet Gudasol here to support you sharing your art + life on Hive.

As a fellow creator, I know how hard it is to get the word out there.

I built cXc.world to help creators like us get more support from the blockchain community + beyond.

Share your music on cXc.world, and copy the Markdown for a easy post includes embedded players for Spotify, Youtube, Soundcloud.

That way, you can earn HIVE + stack streams on centralized platforms, as they do still matter.

Not a music creator? No problem. You can still use cXc.world to find + share music you love.

What's next?

Preview the next evolution of cXc, Tetra.earth.

Expose local music from your area!

We're helping grassroots musicians, and you can too by adding their music (no sign up or WAX account required).

Join our community 🐬

Find fellow music lovers in cXc's Discord

Bad news: Saying see you later to Hive! 👋

We didn't get the needed support to continue cXc.world on Hive, as our DHF proposal lacked votes, but [Good News Everyone] cXc.world will add a Markdown copy button, allowing you to easily share your music + music you find on Hive.

For now, we're on WAX, with tools you can use to mint your own Music/Media NFT collection.

Curious about the future of Earth + ET relations? New economic systems?

Find more apps + art from Gudasol

Want to build tools like I used to share this?

I'd love to show you some tips on AI Code generation