GambleFi Portfolio | Buying 2 More DefiBookie NFTs

If I learned anything in crypto is that you just don't want to chase the pump giving into the FOMO but instead buy when projects seem 'dead'. While some of those will inevitably go to zero, the ones that survive end up making so much gains potentially that is more than offsets the losses. With that in mind, I bought 2 more Defibookie NFTs last week getting my total up to 20.

Defibookie (NFTs)

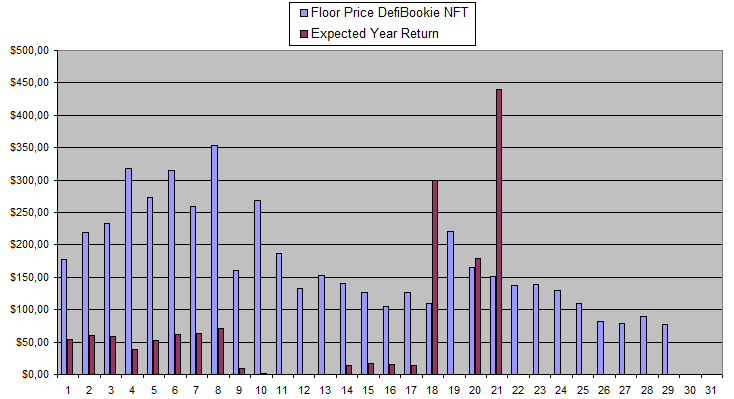

The chart is pretty clear in that there haven't been any payouts either from revenue share or airdrops in 2 months. This has put the price of a NFT at an all-time low of currently 0.458 SOL or ~76$. At a total of 2,217 NFTs this puts the market cap at below 200k while they do actually have a product with some users. They also have tools to market spreading free bets to other NFT or Memecoin communities on Solana. I do however expect another month with no revenue share since they didn't give any mid-month update meaning that most likely the revenue wasn't there. The key now however is that they manage to survive this stage and get in another stage at some point where things improve with hype and prices skyrocketing.

So this remains a calculated gamble having piece in case it would all go to zero. Depending how well I'm doing with the memecoins on Solana, I might but more of these NFTs as I see the current price range as a good risk/reward accumulation zone.

the

| Week | Invested | Floor | Current Value | Week Divs | Total Divs | Recovered | Total |

|---|---|---|---|---|---|---|---|

| Week 01 | 1424$ | 180$ | 2340$ | 0$ | 0$ | 0.00% | +916$ |

| Week 02 | 1424$ | 156$ | 1927$ | 0$ | 0$ | 0.00% | +503$ |

| Week 03 | 1424$ | 177$ | 2191$ | 13.67$ | 13.67$ | 0.96% | +780$ |

| Week 04 | 1421$ | 219$ | 2708$ | 14.92$ | 28.59$ | 2.01% | +1315$ |

| Week 05 | 1421$ | 233$ | 2875$ | 14.49$ | 43.08$ | 3.03% | +1497$ |

| Week 06 | 1421$ | 318$ | 3932$ | 9.444$ | 52.52$ | 3.69% | +2563$ |

| Week 07 | 1421$ | 273$ | 3374$ | 12.95$ | 65.72$ | 4.62% | +2016$ |

| Week 08 | 1421$ | 315$ | 3894$ | 15.24$ | 80.97$ | 5.70% | +2554$ |

| Week 09 | 1421$ | 259$ | 3199$ | 15.97$ | 96.94$ | 6.82% | +1875$ |

| Week 10 | 1421$ | 353$ | 4365$ | 17.67$ | 114.61$ | 8.06% | +3058$ |

| Week 11 | 1421$ | 161$ | 1988$ | 2.13$ | 116.74$ | 8.22% | +684$ |

| Week 12 | 1421$ | 269$ | 3325$ | 0.332$ | 117.07$ | 8.23% | +2021$ |

| Week 13 | 1421$ | 187$ | 2314$ | 0.092$ | 117.16$ | 8.23% | +1010$ |

| Week 14 | 1421$ | 133$ | 1640$ | 0.000$ | 117.16$ | 8.23% | +336$ |

| Week 15 | 1421$ | 153$ | 1885$ | 0.000$ | 117.16$ | 8.23% | +581$ |

| Week 16 | 1421$ | 140$ | 1728$ | 3.310$ | 120.47$ | 8.47% | +427$ |

| Week 17 | 1421$ | 127$ | 1564$ | 4.410$ | 124.88$ | 8.78% | +268$ |

| Week 18 | 1421$ | 102$ | 1287$ | 3.850$ | 128.73$ | 9.06% | -5$ |

| Week 19 | 1421$ | 126$ | 1561$ | 3.320$ | 132.05$ | 9.30% | +272$ |

| Week 20 | 1421$ | 110$ | 1361$ | 74.680$ | 206.74$ | 14.55% | +147$ |

| Week 21 | 1421$ | 221$ | 2730$ | 0.000$ | 206.74$ | 14.55% | +1515$ |

| Week 22 | 1421$ | 164$ | 2044$ | 44.626$ | 251.36$ | 17.69% | +874$ |

| Week 23 | 1421$ | 151$ | 2008$ | 118.52$ | 369.88$ | 26.03% | +956$ |

| Week 24 | 1710$ | 137$ | 1956$ | 0.000$ | 369.88$ | 21.6% | +615$ |

| Week 25 | 1822$ | 139$ | 2114$ | 0.000$ | 369.88$ | 20.3% | +661$ |

| Week 26 | 1822$ | 129$ | 1968$ | 0.000$ | 369.88$ | 20.3% | +515$ |

| Week 26 | 1822$ | 110$ | 1673$ | 0.000$ | 369.88$ | 20.3% | +221$ |

| Week 27 | 1822$ | 81$ | 1242$ | 0.000$ | 369.88$ | 20.3% | -211$ |

| Week 28 | 1993$ | 78$ | 1338$ | 0.000$ | 369.88$ | 18.56% | -285$ |

| Week 29 | 1993$ | 90$ | 1537$ | 0.000$ | 369.88$ | 18.56% | -285$ |

| Week 30 | 2149$ | 77$ | 1458$ | 0.000$ | 369.88$ | 17.21% | -322$ |

Overall so far the damage is limited as I managed to get in during the mint and I also already received some earnings in the past.

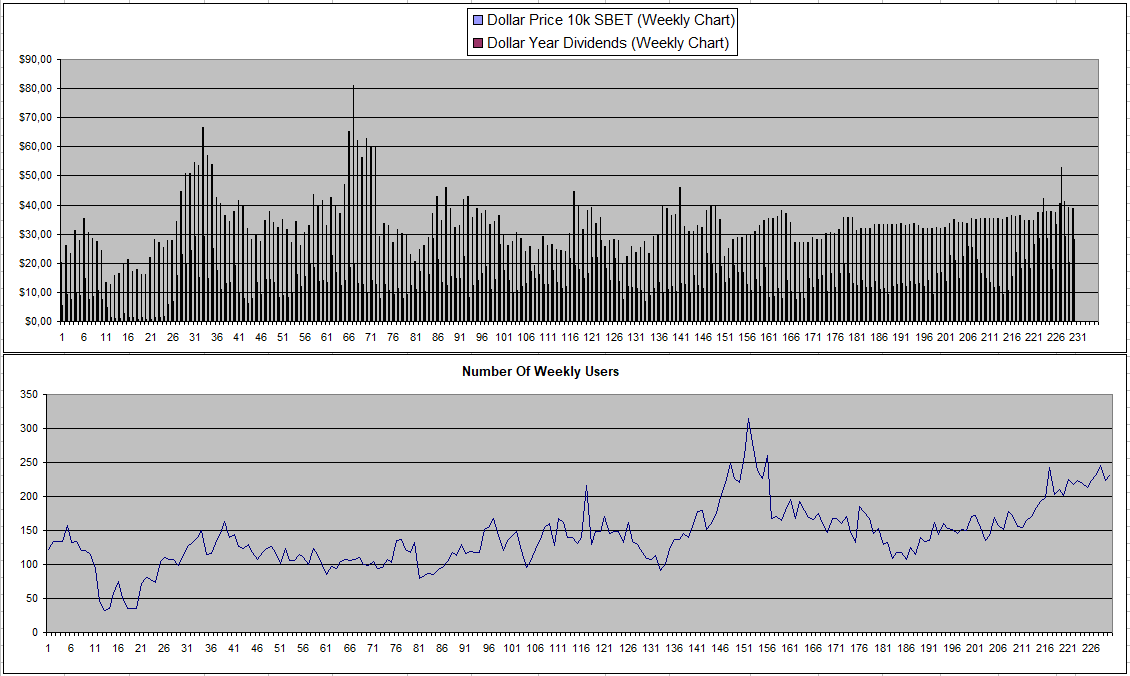

Sportbet.one (SBET)

SBET continues to be its reliable self with weekly Return currently above 1% indicating that it's too cheap. As I stated before, I would buy more if I wasn't already this heavily invested. It will be a very heavy sports Summer with the European Championship and the Olympics so I'm looking forward to what they can do.

So pretty much all continues to work properly on Sportbet

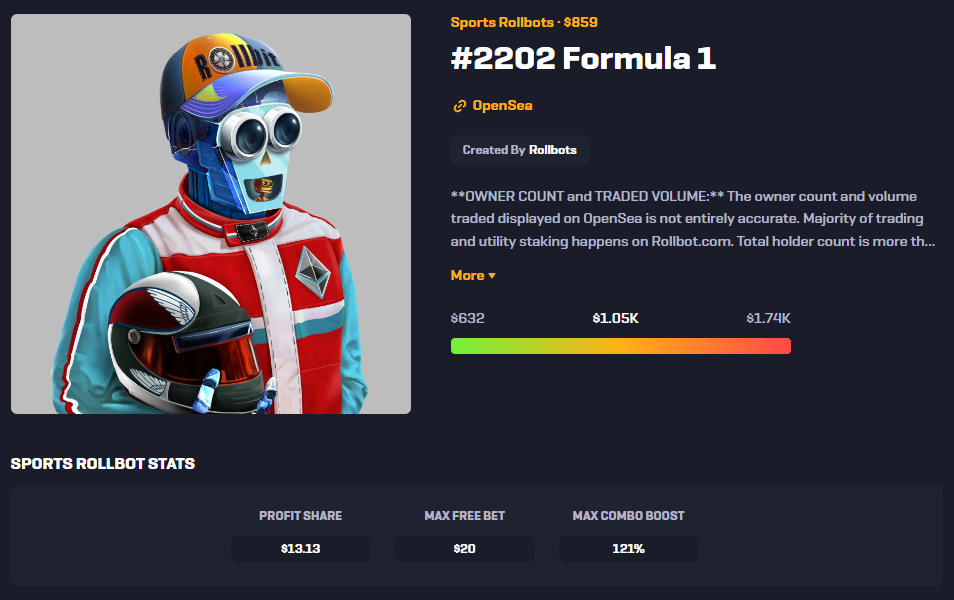

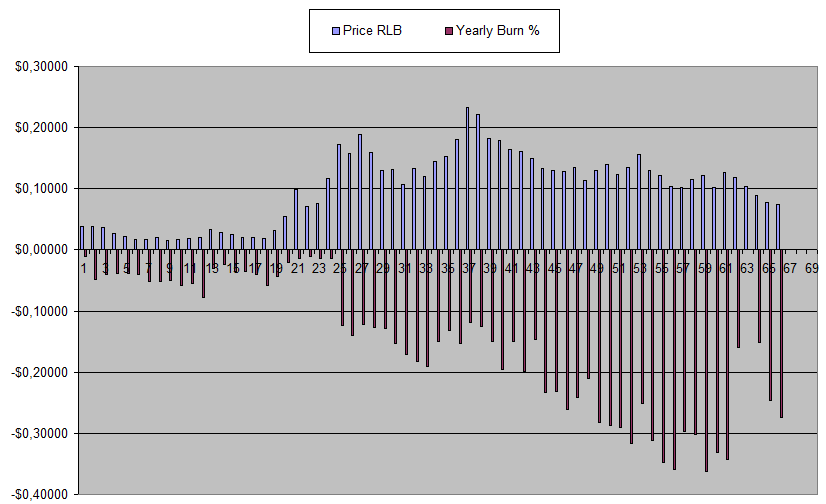

Rollbit.com (RLB) & Rollbot/Sportsbot NFTs

It looks like the sport betting profit made by rollbit has completely collapsed as the bot I sold over a month ago which had 148$ in revenue share dropped last time to 34.17$ and now to just 13.13$. In this sense, crypto really is a PvP game where a seller or a buyer ends up being the winner or the loser.

This said, Rollbit still has a great platform (despite the centralization and the KYC) which is making revenue and burning supply. With the price of RLB having come down, the burn is now increasing. last week around 1 Million Dollars in RLB was burned which equals 0.5% of the total supply. In that regard, I'm still tempted to buy RLB at current prices and just hold and wait for the burn to do it's work which inevitably will have to push the price up. However, I'm not willing to deal with ETH fees or the centralized risk of having too much money on Rollbit itself. So I'm forced to stay away pretty much and this is the case for many potential buyers.

The returns on the 2 NFTs I'm still holding continue to be good but they also aren't really moving the needle.

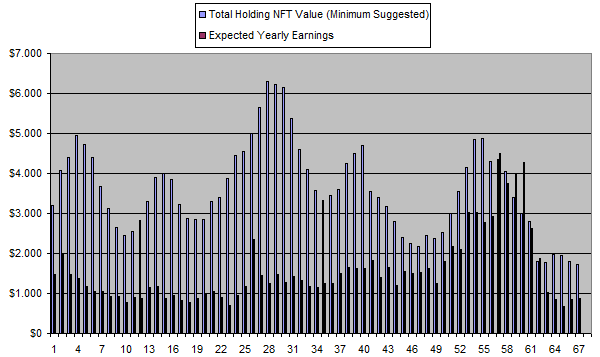

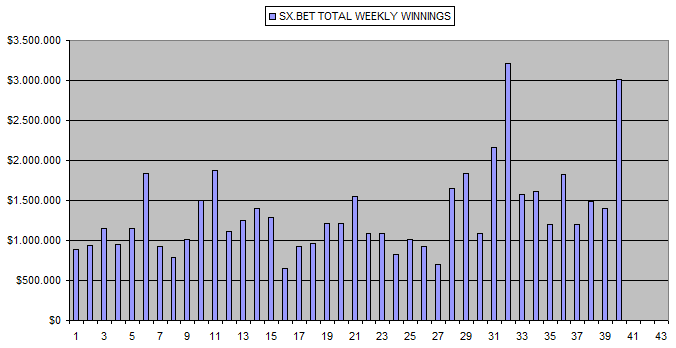

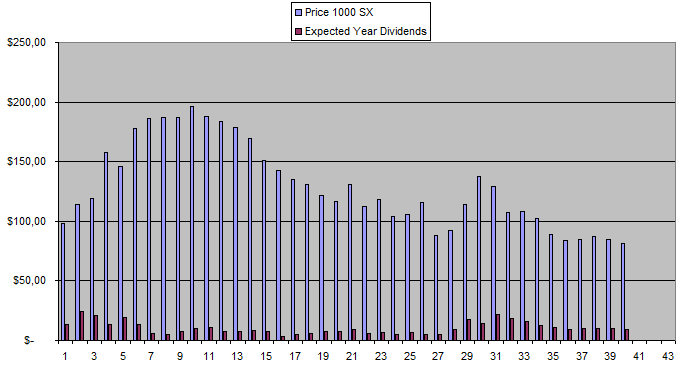

Sx.Bet (SX)

It looks like there was an increase in volume last week for SX and I guess the tennis Grand Slam season will further help this since it tends to be popular on Exchanges. It still remains a uphill battle for them to gain more users.

I am getting tempted to stack some more SX to hold for the very long term as I do see them in the best position to become the Crypto Betfair somewhere in the future.

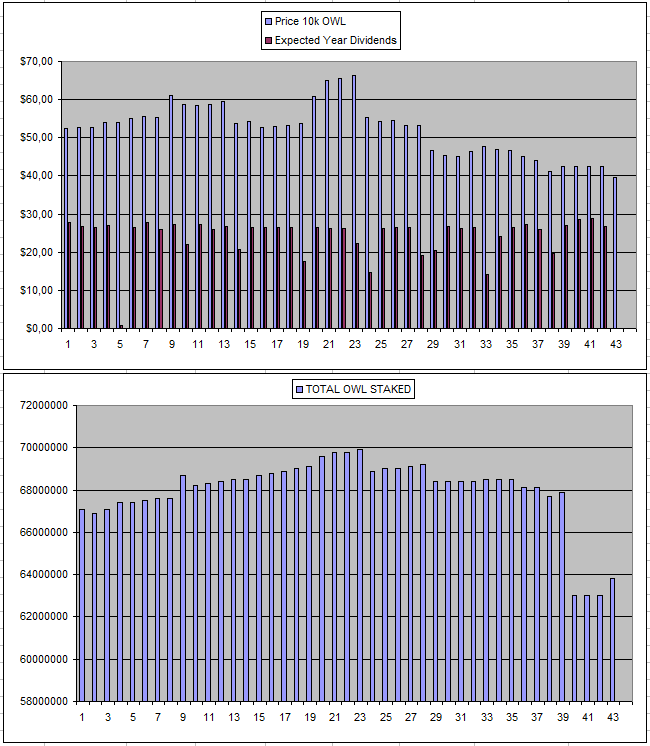

Owl.Games (OWL)

Owl was back to the usual 30$ in weekly earnings for me while the price decline over the last 27 weeks of my holdings combined with the taxes paid to buy, Stake, Unstake, Sell makes it so that I'm overall at a -40$ loss on the investment. This is crazy given that I already earned 34.74% of it back. I still haven't seen anything that really gives me faith in the team or the project and I will just keep collecting the earnings in the hope to fully recover what I put in over time.

After 26 weeks in this project, I earned back 33.71% of my initial investment but I'm down -4$ overall due to the high fees that it takes to buy/ stake / unstake / sell combined with the decline in price.

| Date | Hold | Invested | Value | Week Divs | Total | % recov | Total |

|---|---|---|---|---|---|---|---|

| 08/08/2023 | 395k | 1954$ | 1850$ | 13.76$ | 21.9$ | 1.12% | -82$ |

| 05/09/2023 | 500k | 2636$ | 2437$ | 20.30$ | 83.9$ | 3.18% | -115$ |

| 03/10/2023 | 500k | 2636$ | 2600$ | 21.15$ | 182.99$ | 6.94% | +147$ |

| 07/11/2023 | 600k | 3179$ | 2877$ | 30.43$ | 310.14$ | 9.75% | +8$ |

| 05/12/2023 | 600k | 3179$ | 2851$ | 20.12$ | 421.99$ | 13.27% | +94$ |

| 01/01/2024 | 600k | 3179$ | 3521$ | 25.76$ | 538.76$ | 16.95% | +881$ |

| 08/01/2023 | 600k | 3179$ | 2933$ | 17.00$ | 555.76$ | 17.48% | +310$ |

| 15/01/2024 | 600k | 3179$ | 2879$ | 30.35$ | 586.11$ | 18.43% | +286$ |

| 23/01/2024 | 600k | 3179$ | 2888$ | 30.45$ | 616.56$ | 19.39% | +325$ |

| 30/01/2024 | 600k | 3179$ | 2825$ | 30.45$ | 647.01$ | 20.35% | +293$ |

| 06/02/2024 | 600k | 3179$ | 2825$ | 22.16$ | 669.17$ | 21.05% | +315$ |

| 13/02/2024 | 600k | 3179$ | 2469$ | 23.57$ | 692.74$ | 21.80% | -17$ |

| 20/02/2024 | 600k | 3179$ | 2407$ | 30.74$ | 723.48$ | 22.76% | -48$ |

| 27/02/2024 | 600k | 3179$ | 2385$ | 30.27$ | 753.75$ | 23.71% | -40$ |

| 05/03/2024 | 600k | 3179$ | 2464$ | 30.67$ | 784.42$ | 24.67% | +69$ |

| 12/03/2024 | 600k | 3179$ | 2527$ | 16.29$ | 800.71$ | 25.19% | +148$ |

| 19/03/2024 | 600k | 3179$ | 2485$ | 27.72$ | 828.43$ | 26.06% | +134$ |

| 26/03/2024 | 600k | 3179$ | 2470$ | 30.70$ | 859.13$ | 27.02% | +150$ |

| 02/04/2024 | 600k | 3179$ | 2393$ | 31.35$ | 890.48$ | 28.01% | +104$ |

| 09/04/2024 | 600k | 3179$ | 2330$ | 29.95$ | 920.43$ | 28.95% | +71$ |

| 16/04/2024 | 600k | 3179$ | 2184$ | 22.75$ | 942.18$ | 29.60% | -53$ |

| 23/04/2024 | 600k | 3179$ | 2245$ | 31.25$ | 973.43$ | 30.60% | +39$ |

| 30/04/2024 | 600k | 3179$ | 2245$ | 33.02$ | 1006.45$ | 31.66% | +72$ |

| 07/05/2024 | 600k | 3179$ | 2246$ | 33.40$ | 1040.85$ | 32.74% | +107$ |

| 14/05/2024 | 600k | 3179$ | 2246$ | 30.83$ | 1071.68$ | 33.71% | +138$ |

| 21/05/2024 | 600k | 3179$ | 2103$ | 0.00$ | 1071.68$ | 33.71% | -4$ |

| 28/05/2024 | 600k | 3179$ | 2035$ | 32.81$ | 1104.49$ | 34.74% | -40$ |

** The High 7% cost to go from buying to having it staked and the 5% tax to sell is fully included in the numbers.

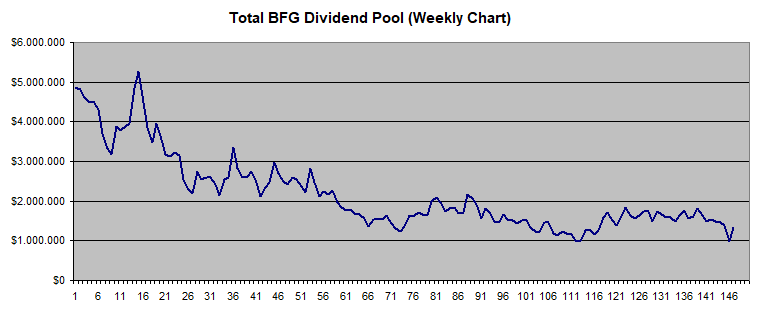

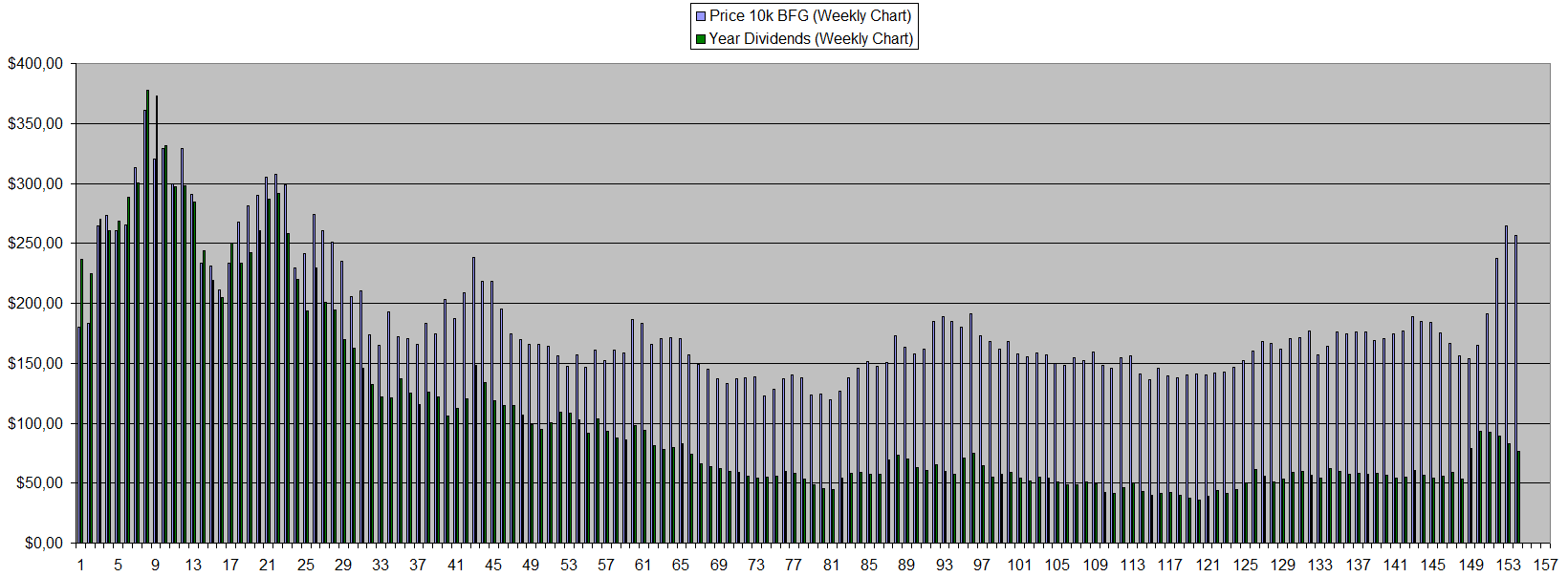

Betfury.io (BFG)

There was a price pump to 0.03$ at some point mainly due to the staking mechanic which was a nice point to potentially take profit for those who are in it for the shorter term as in the end the only real thing that counts is the Dividned pool and the number of users on the platform that provide for the revenue share. Without that going up, any price increase likely will be unsustainable.

Looking at it, this is quite flat while more BFG tends to get staked for at least a year making the earnings and returns go down a bit week by week.

I do expect this trend to continue and for things to normalize again as fundamentally nothing really changed or improved. It's just that earnings now from those who don't stake partially have flown to those who have staked their BFG. This makes the token less liquid and easier to move as many are unable to sell. Over time though, the returns and the dividend pool is what will need to go up in order to see higher price and Divindends. So far this isn't happening.

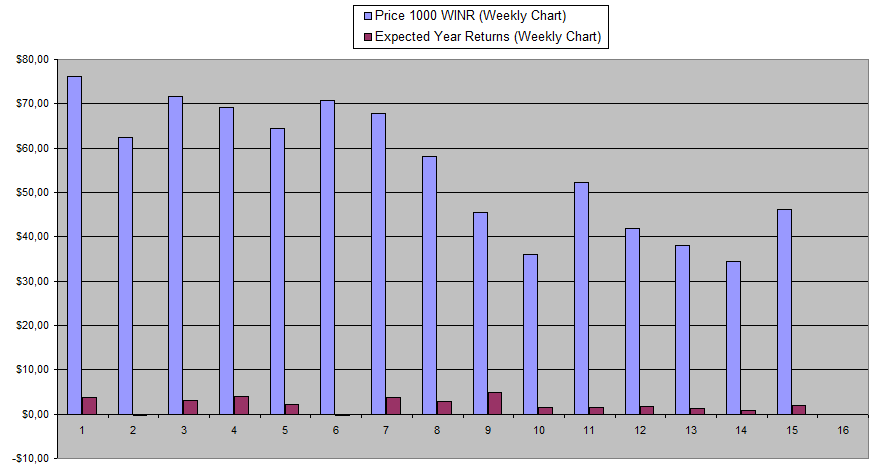

It's now the 2nd time I missed out on potentially picking up some more WINR for cheap under 0.04$. I'm still not fully sold though and the returns also indicate that the price is already set at potential future growth which are things that have held me back. I am keeping my eye out on this one though.

APY Based on Current Price and Dividends from the last 7 days

All these numbers are based on prices of Monday

| Project | APY |

|---|---|

| Sportbet.one (SBET) | +88% APY |

| Betfury.io (BFG) | +29% APY |

| Rollbit.com (NFTs) | +51% APY* |

| Owl.Games (OWL) | +74% APY |

| Sx.Bet (SX) | +11% APY |

| Defibookie.io (NFTs) | +0% APY |

| WINR Protocol (WINR) | +4% APY |

Note: Token prices going up or down have a major influence on the actual returns going forward either amplifying them if they go up or destroying them when the price would dip. These are my personal numbers and RLB varies based on the trait of the Rollbot NFTs you own and (*) they are based on the minimum suggested by prices which can be way lower than the actual prices.

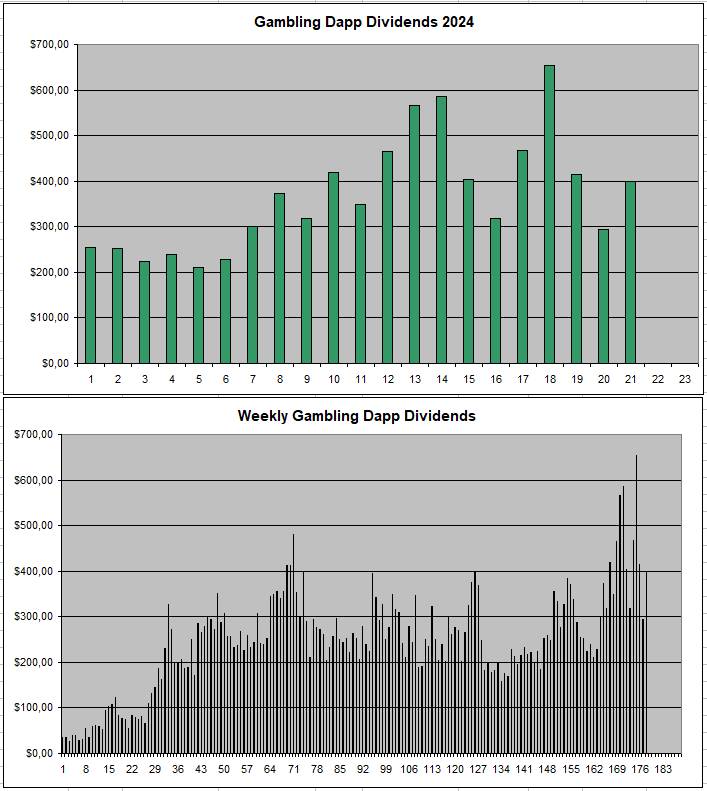

Personal Gambling Dapp Portfolio

I got a total of 398.39$ in passive holding last week for holding holding 5M SBET | 500k BFG | 2 Rollbot NFTs | 600k OWL | 25k SX | 20 DefiBookie NFTs | 10k WINR. I'm still looking to diversify with other good gambling dapps that pay the losses or fees from the gambler to those holding a token. Anyone that has tips on this, please leave a comment below...

Crypto & Blockchain-Based Bookies and Exchanges that I'm personally using with some allowing anonymous betting with no KYC or personal restrictions...

|  |  |

|---|---|---|

|  |  |

|  |  |

Play2Earn Games that I am Playing...

|  |  |

|---|

Posted Using InLeo Alpha